I’m not sure whether to title this post SGG stop hit or just an update to the existing trade. I was just catching up on the comments from Friday’s last post & saw that @jonfitznd inquired about the SSG trade being stopped out which I wasn’t aware of until now.

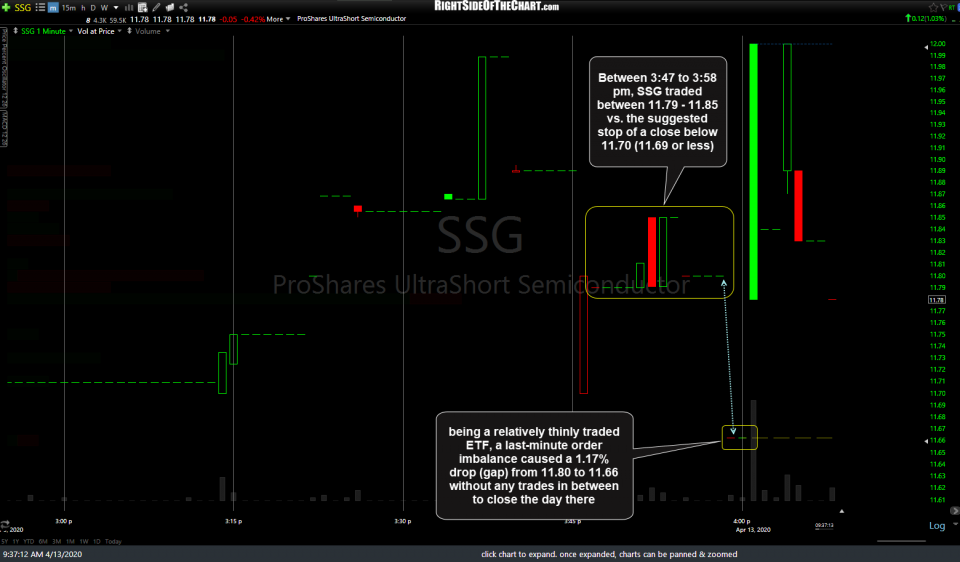

I was monitoring the active trades into the close yesterday as I had to suspend or modify stops on a few lately, including SGG. I had suspended the suggested stop of a daily close below 11.70 on Thursday to be reinstated on Friday. Between 3:47 to 3:58 pm, SSG traded between 11.79 – 11.85 vs. the suggested stop of a close below 11.70 (11.69 or less) so I had assumed it would close comfortably above that stop & didn’t bother suspending or modifying the stop again. However, being relatively thinly traded ETF, a last-minute order imbalance caused a 1.17% drop (gap) from 11.80 to 11.66 without any trades in between to close the day there. 1-minute chart below (white vertical lines show day breaks).

Being a stickler for the official trades, I will have to consider the SSG trade stopped out as I didn’t revise the stop beforehand by posting a revision to the trade in advance. However, this is one example of when to be flexible in trading as I would have suggested giving this one a little more room being that it closed a mere 3 cents below the suggested stop of 11.69 or lower. This is also a reason why I post a lot more unofficial trades vs. official trades as the latter are very time consuming to keep updated with detailed posts including updated charts & commentary.

The previous trade will be considered officially stopped out at 11.66 (Friday’s close) with a new entry on SSG here around the same level (11.65) with the same targets & stop as before. The unadjusted loss for that previous trade is 11.6% or a 5.8% beta-adjusted loss as the suggested position size was 0.5 to account for the 200% leverage on SSG. For those frustrated from the recent whipsaws & revisions to the official trade ideas, I would suggest not taking this new trade on SGG or any other trade ideas at this time as frequent & rapid adjustments to one’s trading plan is an essential part to adapting to an extremely volatile & fast-moving market such as well been in for the past couple of months. Less-active traders & investors might be best to wait for volatile to subside although I don’t foresee that as happening any time soon.