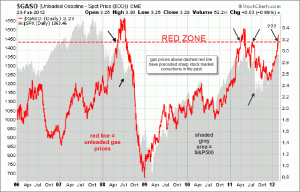

this chart was sent to me by a fellow trader and helps illustrate the fed’s dilemma of continuing to flood the system with liquidity while devaluing the dollar and encouraging speculation (of which oil and commodities has always been a favorite playground for the speculators) by causing oil prices to rise, thereby putting a damper on the chances of a continue and sustained recovery. as sir isaac newton so eloquently put it: “for every reaction, there is an opposite and equal reaction”. rising oil and commodity prices, which stifle economic growth, is a direct by-product of the fed’s money printing/dollar-devaluation/extreme easy money policy which encourages speculation in addition to the inherent inflationary effects.

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}