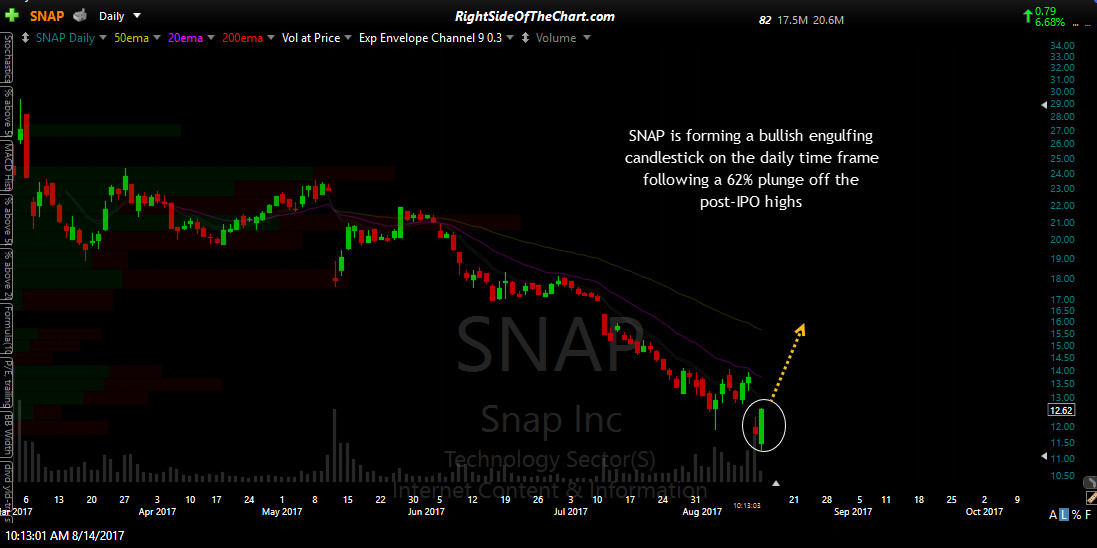

SNAP (Snap Inc) looks poised to snap back after it’s post-IPO carnage, with the stock falling as much as 62% off it’s post IPO high of 29.44 hit the day after the stock started trading. Although the stock has yet to clear even the first of several resistance levels shown on the 60-minute chart below, it appears to me that will most likely occur very soon & quite likely on a very impulsive rally.

- SNAP 60-minute Aug 14th

SNAP will be added as an active long swing trade around current levels with an optimal entry anywhere from 11.50, should it pull back off the resistance level that it is currently testing, to as high as a a break above the 14.10ish resistance level (assuming one is targeting T2 or T3 based on that entry). Price targets for an entry around current levels (slightly below 13.00) are T1 at 13.98, T2 at 15.15 & T3 at 16.80. The suggested stop is any move below 11.45 with a suggested beta-adjustment of 0.70.

On the daily time frame, so far today SNAP has put in a bullish engulfing candlestick. That, coupled with the fact that the stock has bullish divergence on the 60-minute time frame while very oversold makes the the odds for reversal & short-covering rally/short-squeeze fairly high. As SNAP is in a strong downtrend with a very limited trading history, this should be considered an aggressive trade idea.