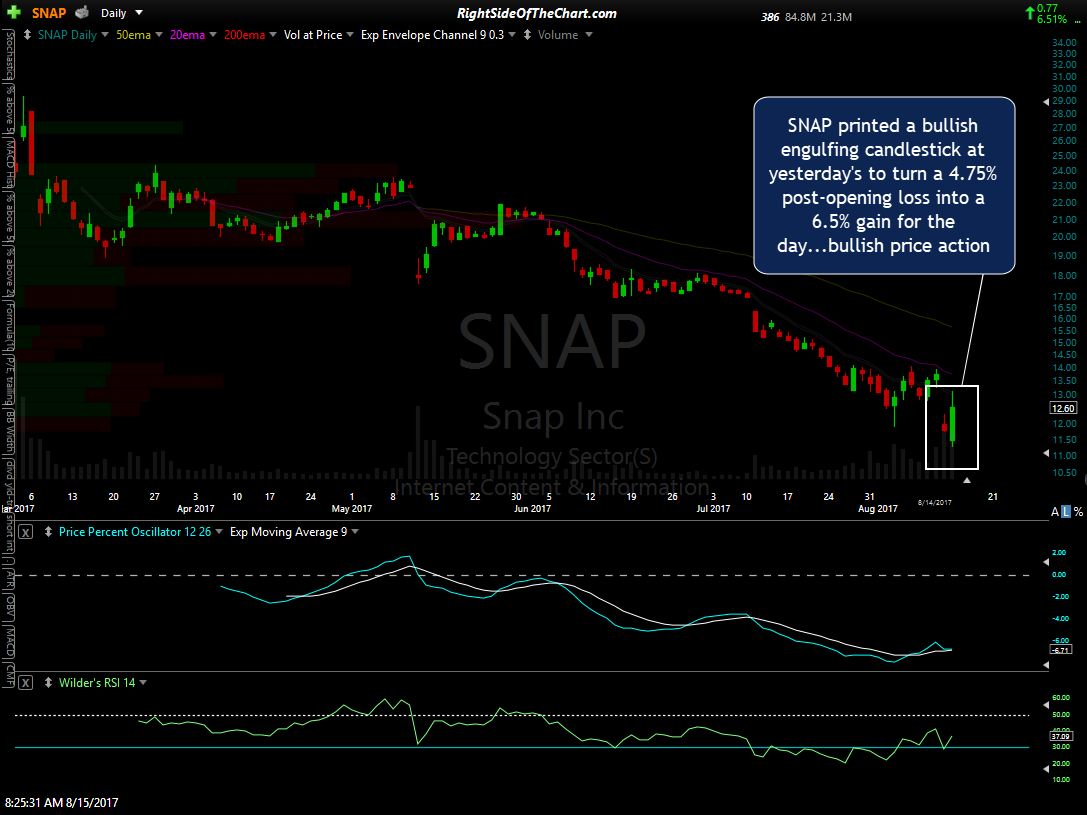

The SNAP active long swing trade did go on to close the day printing a bullish engulfing candlestick, turning a post-opening loss of 4.75% into a gain of 6.5% on the day… quite bullish price action. As with all bullish (or bearish) engulfing candles, I like to see follow through via additional green (or red) candles in the following sessions in order to confirm the buy (sell) signal.

Another potentially bullish development to watch for today is a bullish pennant continuation pattern that was formed after a brief momentum-fueled overshoot of R1 yesterday. That pattern is shown below on the 60-minute time frame along with the measured target which projects to just above the T1 level. To calculate the measured move of a bullish pennant formation, take the distance of the move leading up to the highest point of the pennant & add that to the lowest point of the pattern just below where the breakout occurs. SNAP has yet to break out but as prices are almost at the apex of the pennant, if a breakout is to come it will likely be today. SNAP will trigger an objective entry or add-on to an existing position on an impulsive breakout above the pennant as well as the R1 level today & again on a break out the downtrend line.