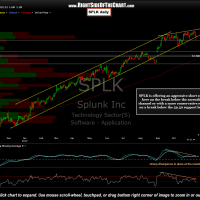

SPLK (Splunk Inc) is about to go “plunk” as this unprofitable stock looks likely to print a close below this ascending channel. Aggressive traders could establish a full or partial position here while those preferring to see confirmation of a breakdown could wait until the 59.50ish support level (S1) gives way. Stops should be based on one’s preferred target but this trade will be considered stopped out on any solid move or close above yesterday’s all-time high of 65.15.

SPLK (Splunk Inc) is about to go “plunk” as this unprofitable stock looks likely to print a close below this ascending channel. Aggressive traders could establish a full or partial position here while those preferring to see confirmation of a breakdown could wait until the 59.50ish support level (S1) gives way. Stops should be based on one’s preferred target but this trade will be considered stopped out on any solid move or close above yesterday’s all-time high of 65.15.

Shorts remain counter-trend trades at this time although there are numerous recent and active short trades that have been successful lately as well as quite a few bearish patterns, such as this one, offering objective entries with decent R/R profiles. My personal preference is to trade the best looking long patterns (primary the commodities related stocks) while shorting the most bearish patterns, particularly the overvalued/overbought names such as SPLK, LNKD, FB, Z, etc.. SPLK daily chart shown: