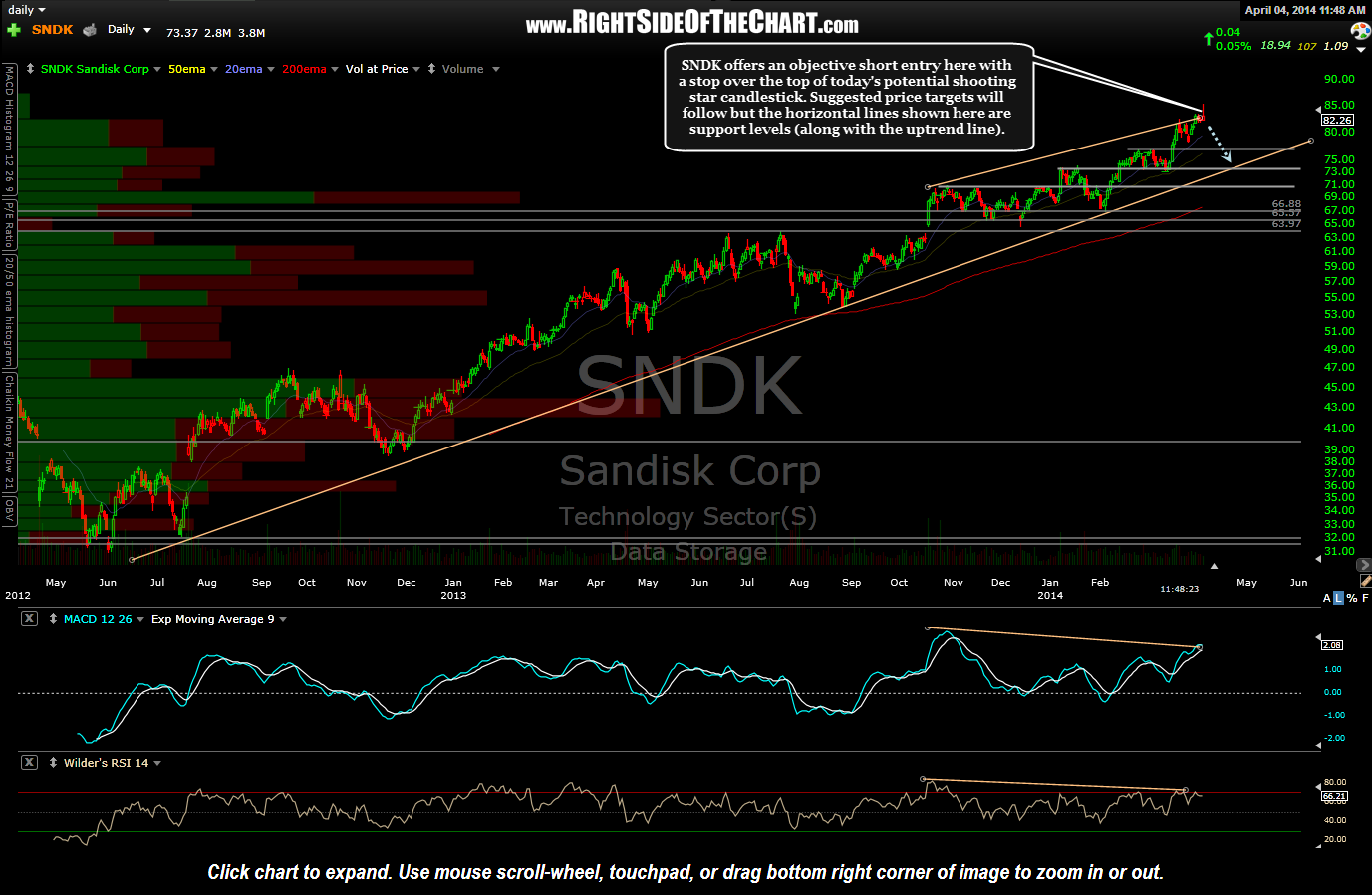

SNDK (Sandisk Corp) looks to offer an attractive R/R with a short enter here on what looks to be shaping up as a shooting star (a potentially bearish topping candlestick formation). A stop over today’s high of 85.37 would provide about a 3 point downside risk while my preferred target range on this trade (exact targets TBD) would be at least 10 points lower & quite possibly nearly 20 points lower, if this trade & the markets continue to play out as expected. If conditions are favorable, I will occasionally enter a short trade at the top of a rising wedge pattern (or the bottom of a bullish falling wedge pattern for longs) as the potential gains on the trade, assuming that prices reverse and go on to break down from the wedge and continue to play out to the measured target of the pattern, are very large compared to downside risk if stopped out as tight stops can be used. Shorting the top (or long at the bottom) of a wedge typically has a higher chance of failure on the trade (vs. waiting for a breakout of the pattern) but when factoring in the above average R/R, on balance I’ve found these type of trades to be very profitable.

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}