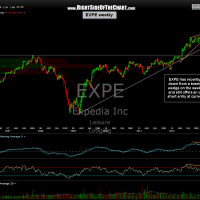

I am adding EXPE back as an Active Short Trade here around the 62 level. EXPE was recently a short trade that hit the first target for a 9% gain back in late Oct and then bounced and was moved to the Completed Trades category. I also mentioned that I still liked the pattern and that longer-term traders could give the trade a little more room as I might add EXPE back as another short trade soon. Based on these updated weekly and daily charts, I think that the stock is now offering an objective entry for a potentially long-term swing short trade. Longer-term traders might choose to focus on the two targets shown below on the weekly chart while shorter-term or more active traders might prefer to target any or all of the levels on this daily chart. Stops should be set according to which target(s) one prefers using at least a 3:1 R/R ratio. Those targeting only T1 could also consider a stop not too far above the recent highs, maybe around the 68.50 area. Daily & weekly charts:

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}