Although I made the decision, for various reasons, not to have an open discussion forum on this site, at least not while I continue to build it out, I do welcome feedback, questions, and trade ideas via the Contact link found under the Resources tab at the top of the page. Last night, a follower of the site brought the recent CRM short trade, which was stopped out about a month ago, to my attention. I had taken the stock off my radar but as Rick has pointed out to me, CRM looks as good, if not better, for a long-term swing short opportunity as it did a month or so ago.

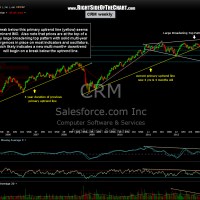

Essentially, the stock is still at the top of that very large broadening top pattern that I highlighted on the weekly chart but as Rick has noted, prices are now flirting with a very critical multi-year uptrend line that has defined the recent bull market in CRM since it Nov 2008 lows. My variation of the draw on this trendline has prices sitting right on the trendline so one could wait until a solid break or weekly close below for a confirmed sell signal. However, based on all other technical evidence: Prices at the top of the broadening wedge pattern with strong divergences in place (weekly frame); The recent breakdown and backtest of the rising wedge pattern on the daily time frame; The astronomical valuation (683 p/e ratio), and the fact that CRM is nearly 4 1/2 years into an aging bull run; etc…., I am going to add the stock as short here (current price is 167.10 as I type).

Again, this is an anticipatory trade as I am shorting the stock while it sits on key support (long-term uptrend line) as well as just above a decent support level around 160.70 (shown on the daily chart). Therefore, a more conservative/conventional trader could wait for prices to move below both those level for confirmation before shorting or adding a second lot to the position. At this time, my preferred swing target is T3 (96.90) and as such, my stop will be about 3% above the recent highs which would provide better than a 3:1 R/R on the trade. Of course, a tighter stop would be suggested for those targeting the first or second targets or a more liberal stop for those targeting T4. Daily & weekly charts below.