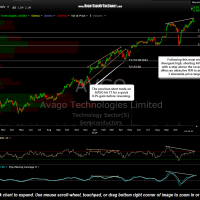

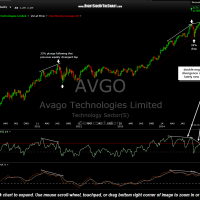

Following this most recent divergent high, shorting AVGO (Avago Technologies Ltd) here around the 92ish level with a stop above the recent high of 94.43 offers an attractive R/R to any of the 3 downside price targets (up to a 9:1 R/R to final target of 69.20). AVGO is currently trading at 91.93.

The previous short trade on AVGO earlier this year was good for a quick 8.3% gain, with AVGO reversing right off the support line located just below the T1 level. As back then, AVGO has recently put in a divergent high although this most recent divergent high is also accompanied by a more powerful double-divergent high on the weekly chart (below). As the short, intermediate & long-term trends in the broad market are all bullish at this time, any short trades should be considered aggressive, counter-trend trades. As always, trade according to your own personal trading style & risk tolerance.

- AVGO daily Dec 2nd

- AVGO weekly Dec 2nd