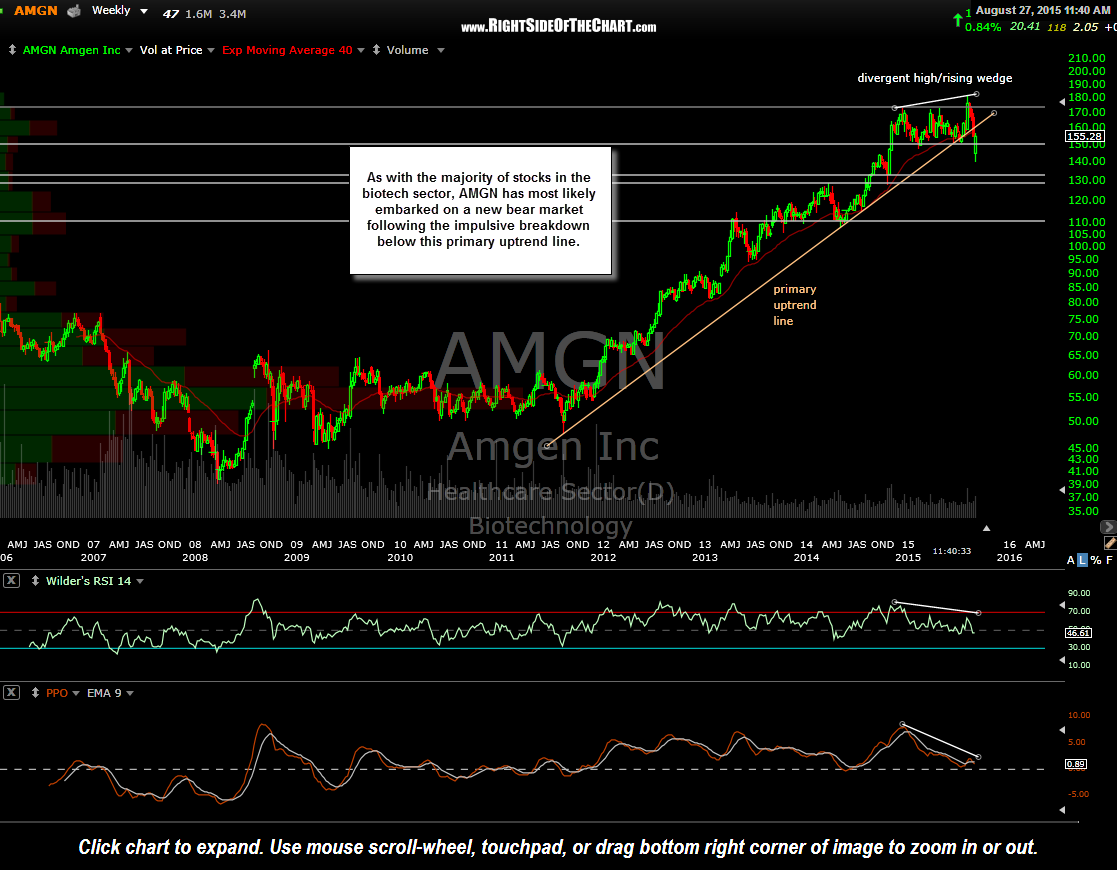

AMGN (Amgen Inc) offers an objective short entry here on the backtest of the recently broken uptrend line. Suggested stop over 167 if targeting T3, lower if targeting T1 or T2. Daily chart below:

On a related note, it would be impossible to add all of the biotech stocks that have currently bounced back to at or near their recently key former support levels (e.g. – trendlines, rising wedges, horizontal support, etc…) that were recently broken. LABU (3x Bullish/Long Biotech ETF) remains an Active Short Trade and is a simple way to short the biotech sector while gaining diversity amongst numerous stocks in the sector. As always, make sure to take into account the 3x leverage when determining your position size, assuming that shorting the biotech sector fits your risk tolerance & aligns with your current market bias & trading plan.

I may add additional individual biotech stocks as official short trade ideas but for those interesting in the sector, I would highly recommend that you view the July 30th Biotech Tech Wreck video, as the charts of my favorite biotech short trade ideas were covered in detail.