SFY (Swift Energy Co.) was mentioned yesterday as one of several bounce/potential long-term swing trade candidates in the Peak Oil vs. Oil Glut post. As with most of those trade ideas (additional charts/notes on the remainder to follow tomorrow), SFY is in the process of forming some potentially strong bullish divergences on the daily time frame. As crude prices have yet to show any convincing signs of a bottom on the daily or weekly time frames (although bullish price action was pointed out on the 60 minute time frames earlier), I am currently viewing SFY and the other energy sector trade ideas mentioned yesterday as short-term oversold bounce trade ideas. However, the potential does exist for these trade to morph into much longer-term swing trades/investments, once again, largely dependent on how crude oil trades going forward.

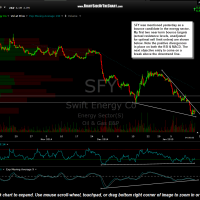

- SFY 60 minute Jan 14th

- SFY daily Jan 14th

- SFY weekly Jan 14th

The next objective entry or add-on for those who established a starter position yesterday would be on a break above the downtrend line on this 60-minute chart. My price targets are the horizontal resistance levels at 2.61 & 2.96 (with the actually sell limits to be set a few cents below those levels). Stops dependent on one’s average cost/entry price. 60 minute, daily & weekly charts above.