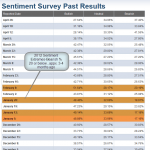

There often seems to be a lot of confusion or misinterpretation when it comes to utilizing investor sentiment, such as the IIAA Sentiment Survey below, as a contrary indicator. Conventional wisdom says that when most traders are bullish, all the willing buyers are already in the market (their capital fully committed) so there are no buyers left and supply will soon overwhelm demand. Vice versa when bearish sentiment reaches an extreme; most market participants have already sold and therefore, demand will soon overwhelm supply, driving prices higher. You also get additional buying from the shorts (bears) who must close their positions at some time. Of course, I’m speaking in general, not absolute terms here but that’s basically the reasoning behind why the market usually drops when bullishness hits extremes and vice versa when bearishness peaks.

With that being said, I just wanted to share the following. First off, using investor sentiment is only one of many tools in helping to forecast where the market might be going in the future but it is far from any type of exact timing indicator. I also find investor sentiment almost completely useless to help forecast market direction unless it is at extreme readings, which usually only happens a couple of times per year, if that. Finally, as the first chart below illustrates, there is often a pretty significant lag between when these extremes are recorded to when their effects actually start playing out.

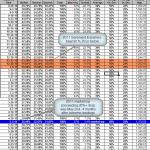

The first chart below is one of many examples that I have seen in the past. I highlighted not just the extreme bullish readings but those that were accompanied by extreme bearish readings as well (any bearish readings of 20% or below). As you can see, these extreme bullish to bearish readings came about 4 months before the market peaked on may 2, 2011 and subsequently fell over 20%. Since that cluster readings just over a year ago, we’ve only seen one other cluster of such extreme readings and that was in January and February of this year. Maybe these readings play out like before, maybe not but I did want to point out the fact that bearishness often peaks well before the market does, as I’ve recently heard the case made that the extreme bearish sentiment earlier this year is a reason that the market is going to continue to go much higher throughout 2012.