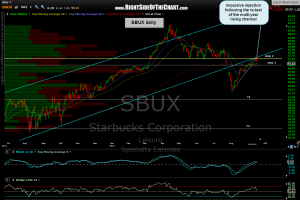

the SBUX short made a push back up to re-test the bottom of that multi-year channel (see previous charts) from below and followed up with a very impulsive downside reaction, further validating that channel and still providing an objective entry or add-on to the short. in my previous post, i had listed two possible stop areas and stated that my preference would be stop 2, which would likely coincide with a re-test of the channel from below. prices also broke below that shorter-term (dotted) uptrend line shown on this updated daily chart, helping add to the case for a second sell signal. targets remain as marked and a hard stop should now be considered on any solid move back above the recent reaction high of 52.00 (stop around the 52.12 area).

the SBUX short made a push back up to re-test the bottom of that multi-year channel (see previous charts) from below and followed up with a very impulsive downside reaction, further validating that channel and still providing an objective entry or add-on to the short. in my previous post, i had listed two possible stop areas and stated that my preference would be stop 2, which would likely coincide with a re-test of the channel from below. prices also broke below that shorter-term (dotted) uptrend line shown on this updated daily chart, helping add to the case for a second sell signal. targets remain as marked and a hard stop should now be considered on any solid move back above the recent reaction high of 52.00 (stop around the 52.12 area).