IWM (Russell 2000) buy signal to come on a solid break above this 60-minute downtrend line with a current maximum bounce target of the primary downtrend line off the highs.

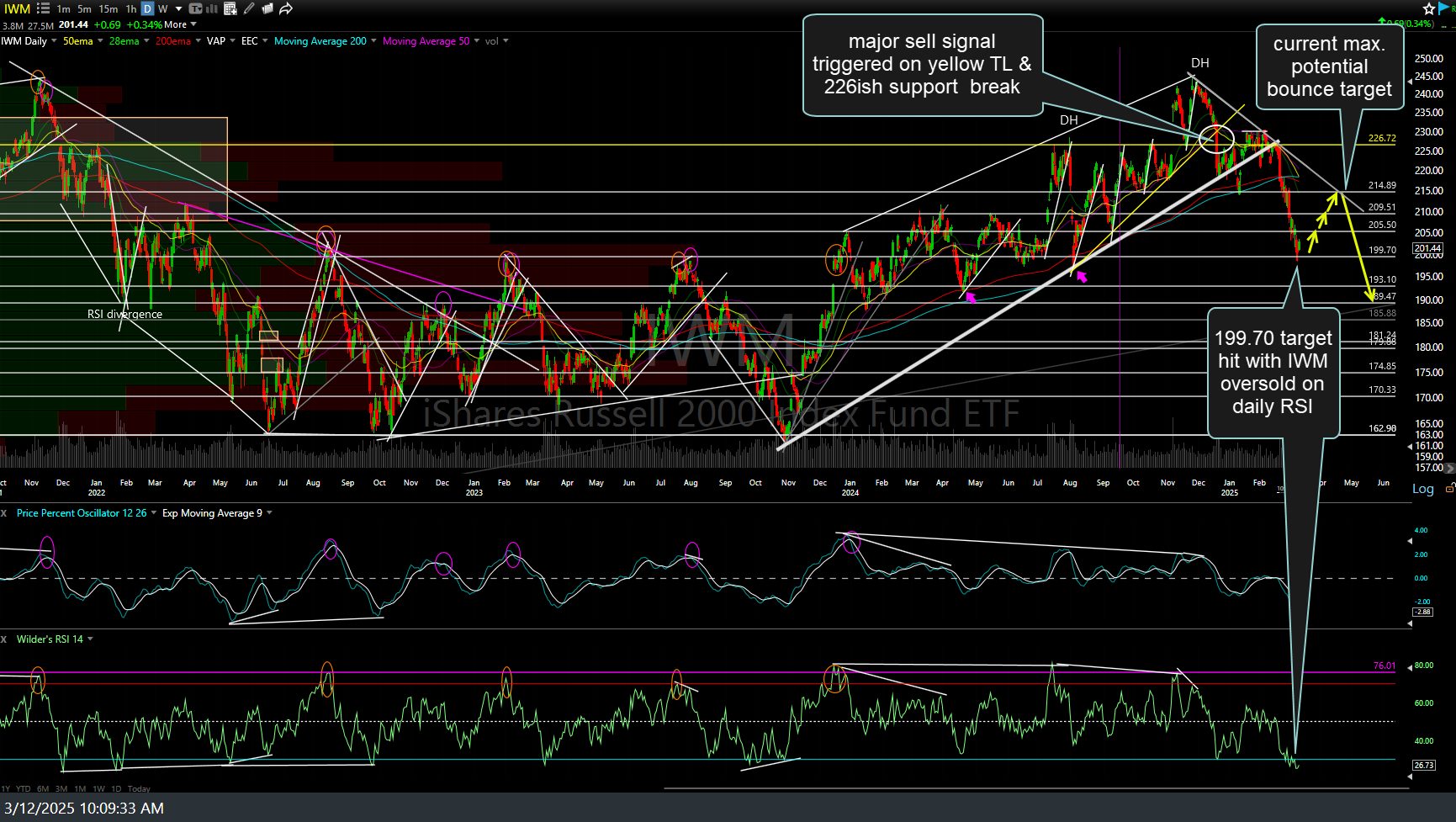

Although IWM has been covered in videos many times since, the last daily chart I posted (first below) was back on Dec 18th, calling for a deeper correction when my key yellow uptrend line & nearby 226ish price support level was taken out. That was a very timely (and profitable) post as IWM went on to trigger that major sell signal that very day with a massive red candlestick down below both supports & has been good for a 14% profit from that entry so far (although we already had a previous short/sell signal on the minor trendline break just off the highs).

IWM hit my 199.70 target (the horizontal line capturing those March, June, & July ’24 reaction lows on that Dec 18th chart) yesterday & remains above it today, thereby offering an objective, yet aggressive entry, as there isn’t any decent evidence of a trend reversal yet. As such, long-term swing or trend traders still short IWM & holding out for additional downside (which I still favor in the coming months+) might opt to lower stops to protect profits at this time.

More active swing traders might opt to either take a starter (partial) long position here (aggressive, as still in a powerful downtrend with no buy signals yet) and/or on a buy signal with a solid breakout above the downtrend line on the 60-minute chart at the top of this post. I’ve also included a 120-minute chart of /RTY (Russell 2000 futures) above, which will trigger a buy signal on a solid break above the bullish falling wedge & the same maximum potential bounce target of the downtrend line off the highs.