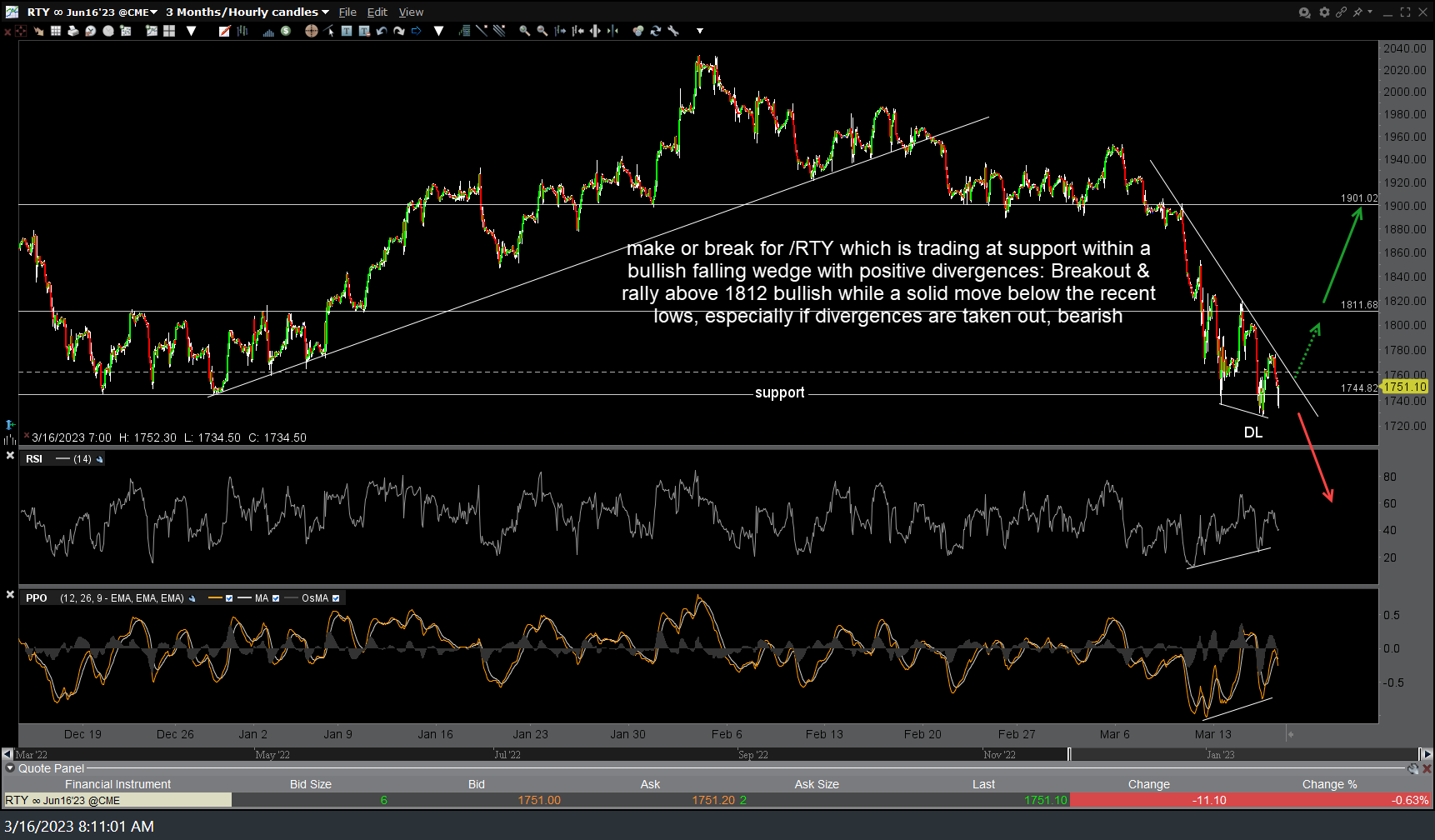

Looks like make it or break it for /RTY & IWM (Russell 2000 Small-caps futures & ETF) which are trading at support within a bullish falling wedge with positive divergences: A solid breakout & rally above the falling wedge/downtrend line & then especially above the 1812 resistance on /RTY & 177 resistance on IWM would be bullish while a solid move below the recent lows, especially if divergences are taken out, quite bearish IMO as fewer things in technical analysis are more bearish than a failure of such a text-book looking bullish setup to pan out.