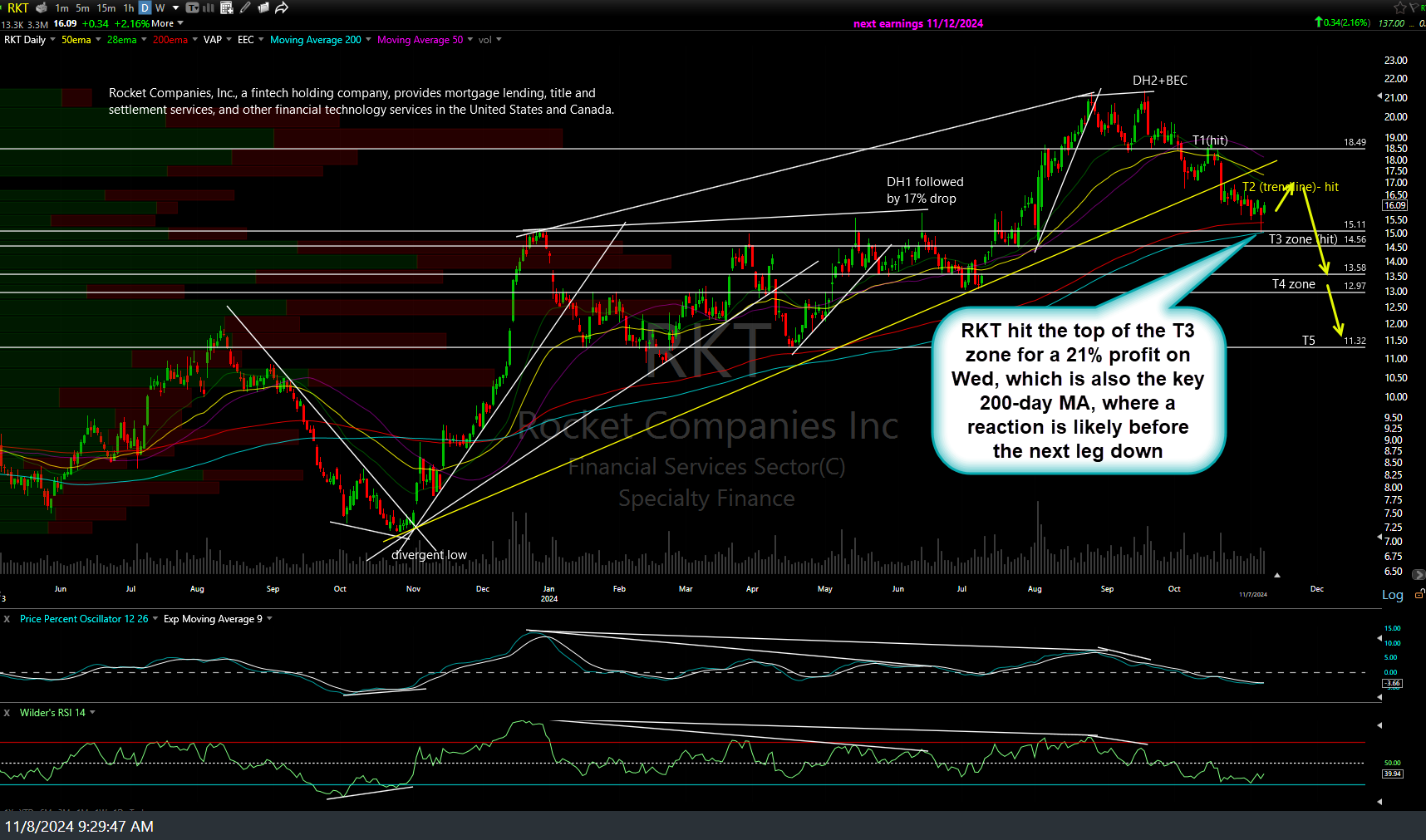

The RKT (Rocket Companies) short swing trade hit the top of the T3 zone for a 21% profit on Wednesday, which is also the key 200-day MA, where a reaction is likely before the next leg down. The third target zone is significant resistance so my preference is to either book full profits or tighten up stops if holding out for any of the additional targets.

Should Treasury bonds bounce (i.e.- 1o-yr yield fall), as the charts indicate is likely, that would be a net tailwind (bullish) for RKT in the near-term. Should $TNX solidly breakout above the current downtrend line it has been testing & run, that would be bearish for RKT. Previous & updated daily charts above.