I will post most of the new trade setups, including the long-side bounce candidates, over the weekend. Personally, I’m more interested in continuing to book profits on existing swing short trades throughout today and not so keen on opening new positions, long or short, before the weekend as it’s just not worth the risk of going home heavily positioned today and getting caught on the wrong side of a gap on Monday morning.

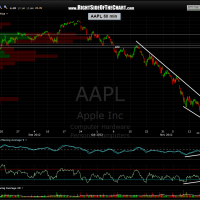

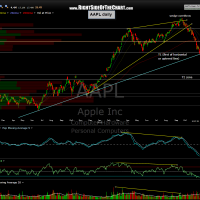

One long-candidate that I am adding now though is AAPL. As I’ve stated recently, my preferred scenario would be to see AAPL drop to that primary uptrend line on my daily chart and as you can see below, the stock is basically at that level now. In fact, I am most likely going to start scaling into some AAPL long after I finish this post. One other thing to note is that AAPL currently has positive divergence on the 60 minute chart, something that I like to see before considering going long in a strong downtrend. Basically, my criteria for reversing short to long in a downtrend are 1) prices hitting a key support level(s) and 2) positive divergences on the 60 minute or higher time frames, both of which are now in place. As such, I am also considering AAPL a completed short trade for now and removing it from the Active Trades-Short category and adding it as an Active Long trade here at 515.95 with a stop to be posted shortly (target shown on chart but I will also provide that level soon).