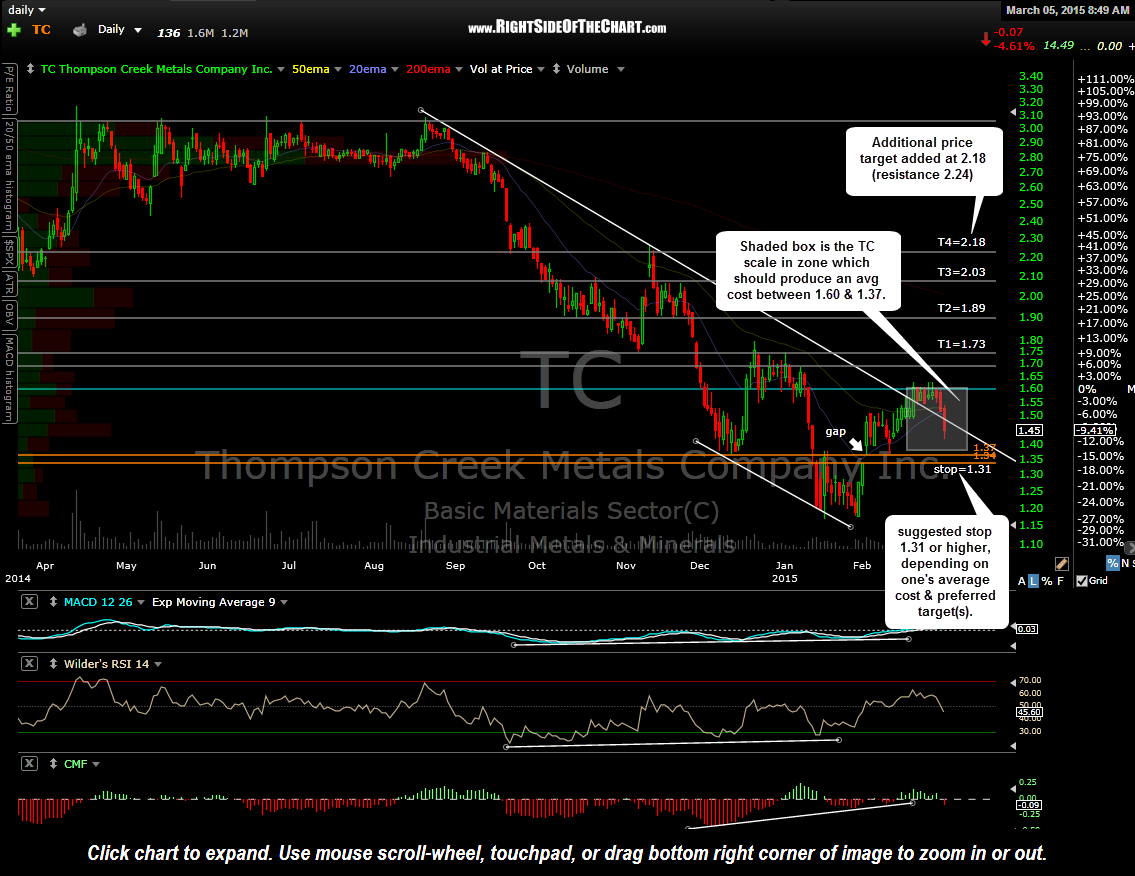

I wanted to update both the REMX (Rare Earth Metals ETF) and TC (Thompson Creek Metals Co.) rare earth stock trade ideas. Starting with the daily chart of TC below, I have added another swing target, T4 at 2.18, which is set just below the actual resistance level of 2.24. I have also added a suggested stop level of 1.31, which is set just below the bottom of the Feb 3rd gap which runs from 1.34 -1.37, as that gap is likely to contain any pullbacks should the stock continue to drift lower.

Based on the original entry price of 1.60, that sounds like a very large percentage drop and not inline with my usual 3:1 R/R. However, there are several factors to take into consideration with this trade. First & most importantly, it was stated in the original trade setup for TC that “my preference is to use a shotgun approach, buying relatively small positions in the individual rare earth stocks along with a core swing position/potential long-term trade in REMX.” As such, the original entry at 1.60 was just a small starter position that I plan to, but have not yet added to (more on that below). Should I decided to continue to build a position in TC, 1) Even when/if I get to my full planned allotment of TC, it will still represent a very small position relative to what I refer to as a “typical swing trade position size” and 2) My final cost basis should be substantially below 1.60 as my scale in zone (where I will buy) runs from 1.60 down to the top of that gap at 1.37.

The decision to take a much smaller than normal position size is based on two factors: 1) The beta-adjustment that I often refer to when trading extremely volatile securities and 2) The fact that I plan to use a shotgun approach to trading multiple individual rare earth producers, hence, it is imperative to keep each individual position size small to avoid over-exposure to the sector. I also own & will most likely continue to add to REMX as a core position, yet another reason to keep the position size on more volatile, individual stocks small.

Taking into account the well-below average position size on TC plus the fact that either my cost basis will be below 1.60 (but above 1.37) or my total position size will be so small, should I decide not to add any shares to my TC position, that if I am stopped out at 1.31, my total dollar loss would either be inline or well below the average dollar loss on a typical stopped out trade. Quite the detailed explanation but I felt that it is important to convey the reasoning & methodology behind such a trade as at a quick glance, one might think that a 17% stop loss (from a 1.60 entry to a 1.31 stop) is too large or unacceptable. From a simple R/R perspective, let’s assuming that I do continue to scale into TC and my total average cost, once I’ve acquired a full position, is 1.50. That would give TC an downside risk of losing 0.19 with an upside profit potential of 0.68 or an R/R of 3.6:1 (and remember, additional longer-term target are likely to be added if/as I continue to see bullish developments in the sector.

Moving onto the outlook for TC as well as the rare earth metals sector as a whole, whether or not these trades work out (REMX & TC are the only two rare earth related Active Trades right now with the others only Trade Setups with entry criteria TBD), if & when I continue to add to these positions will depend largely on the developments that I see in gold & the gold mining stocks. As the chart of TC overlaid with GLD below illustrates, gold (a “precious” metal) and rare earth metal stocks (“rare” metals), are highly correlated. As such, with both gold & the gold mining stocks currently flirting with key support, both gold & the rare earth stocks are at an important technical juncture that could break either way. My preference is to wait to see gold & the gold mining stocks begin to move above current levels, even if we get (another) brief flush-out move below support first. Updated on gold & the PM mining sector to follow in a separate post soon.

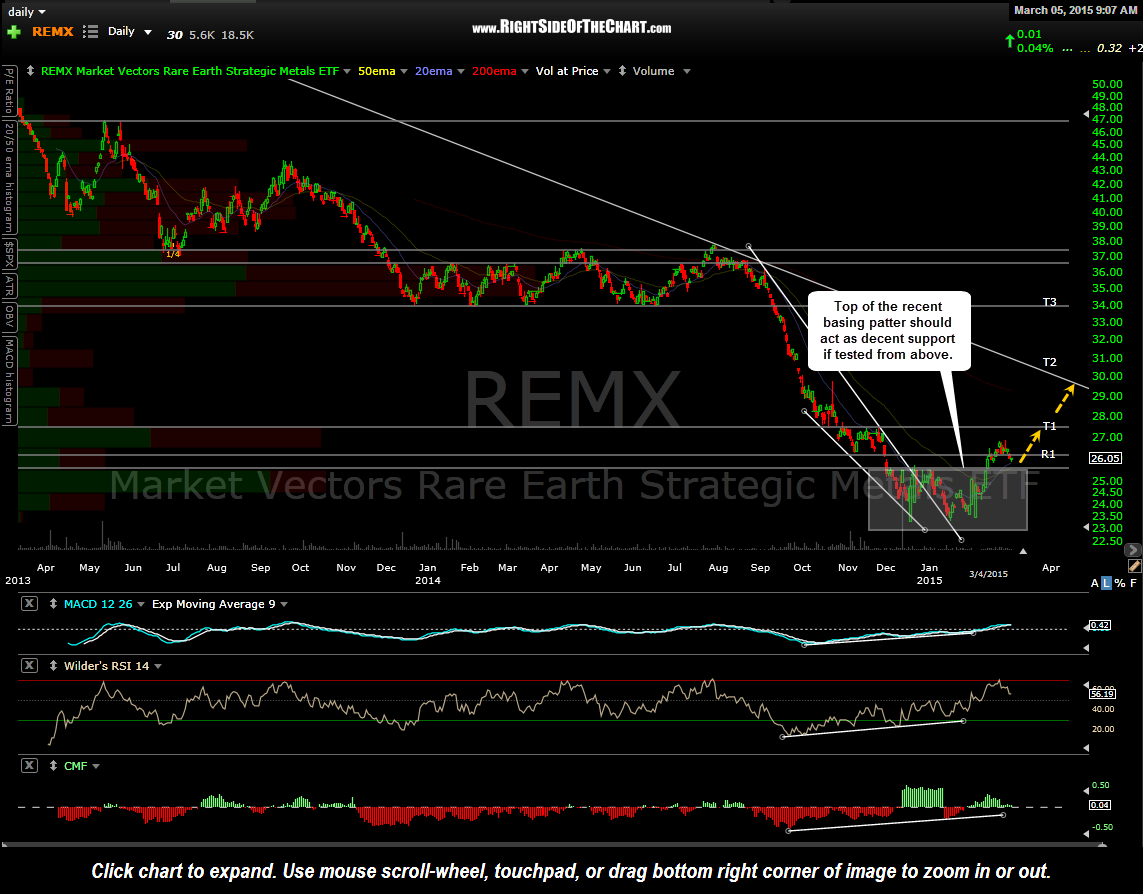

Finally, the updated chart of REMX shows that the rare earth stocks as a whole still look more than fine from a technical perspective, following the recent breakout above the early Dec to mid-Feb trading range/basing pattern, the top of which should act as decent support should prices continue to drift a bit lower. As of now, the recent weakness in the rare earths stocks is most likely attributed to profit taking following the strong rally off the early Feb lows as well as the recent weakness in the precious metals stocks.