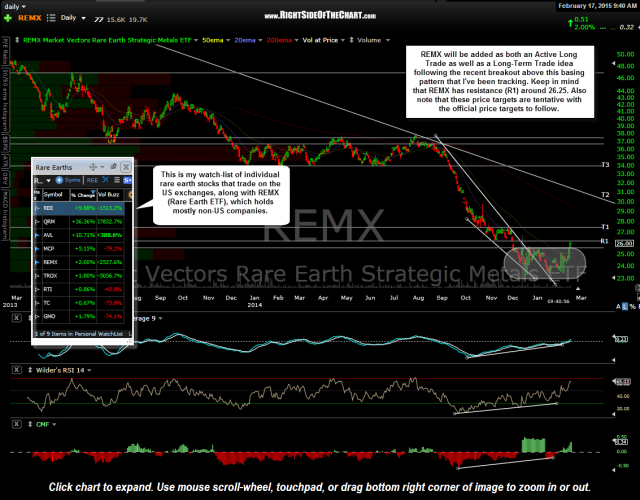

REMX (Rare Earth Metals ETF) will be added as both an Active Long Trade (i.e.- typical swing trade) as well as a Long-Term Trade Idea. Coming into the year bullish on commodities, I’ve been closely following the Rare Earth stocks. The sector has just been completely & utterly annihilated since topping in early 2011 with an all-out crash in rare earth metal prices (and much greater losses in many of the rare earth producers).

Recently, I’ve noticed some very impulsive buying coming into most of the individual rare earth producers that I follow. My rare earth stock watchlist, which is comprised of only 8 companies that trade on US exchanges, is pasted to this daily chart of REMX. As the bulk of rare earth metals are extracted outside the US, REMX is comprised primarily of non-US companies and is a diversified way to gain exposure to the sector for either a swing trade (lasting several weeks to several months) as well as a Long-term Trade (i.e.- trend trade or investment), lasting several months or even years.

My personal strategy has been, and will continue to be, to scale into the various individual rare earth producers on my watchlist as well as REMX. I have been swamped with the recent programming changes to the site but will post charts on a few of the individual rare earth stocks as soon as I get the time. In the meanwhile, my watchlist is pasted on this chart for aggressive traders who want more select or concentrated exposure to the sector. Keep in mind that many of the stocks on my list are very low-priced & extremely volatile (i.e.- high potential for both gains AND losses). Consider a substantial downside adjustment in the position size (beta-adjusted position sizing) of any of the individual rare earth stocks as well as using a shotgun approach (buying several names instead of one or two) if you decide to go that route.