After the typical reaction off the initial tag of T2, the MBI (MBIA Inc) swing short trade is close to triggering the next sell signal/objective short add-on or re-entry on a break below T2 & more importantly, a red flag for the municipal bond market. Original & updated daily charts below.

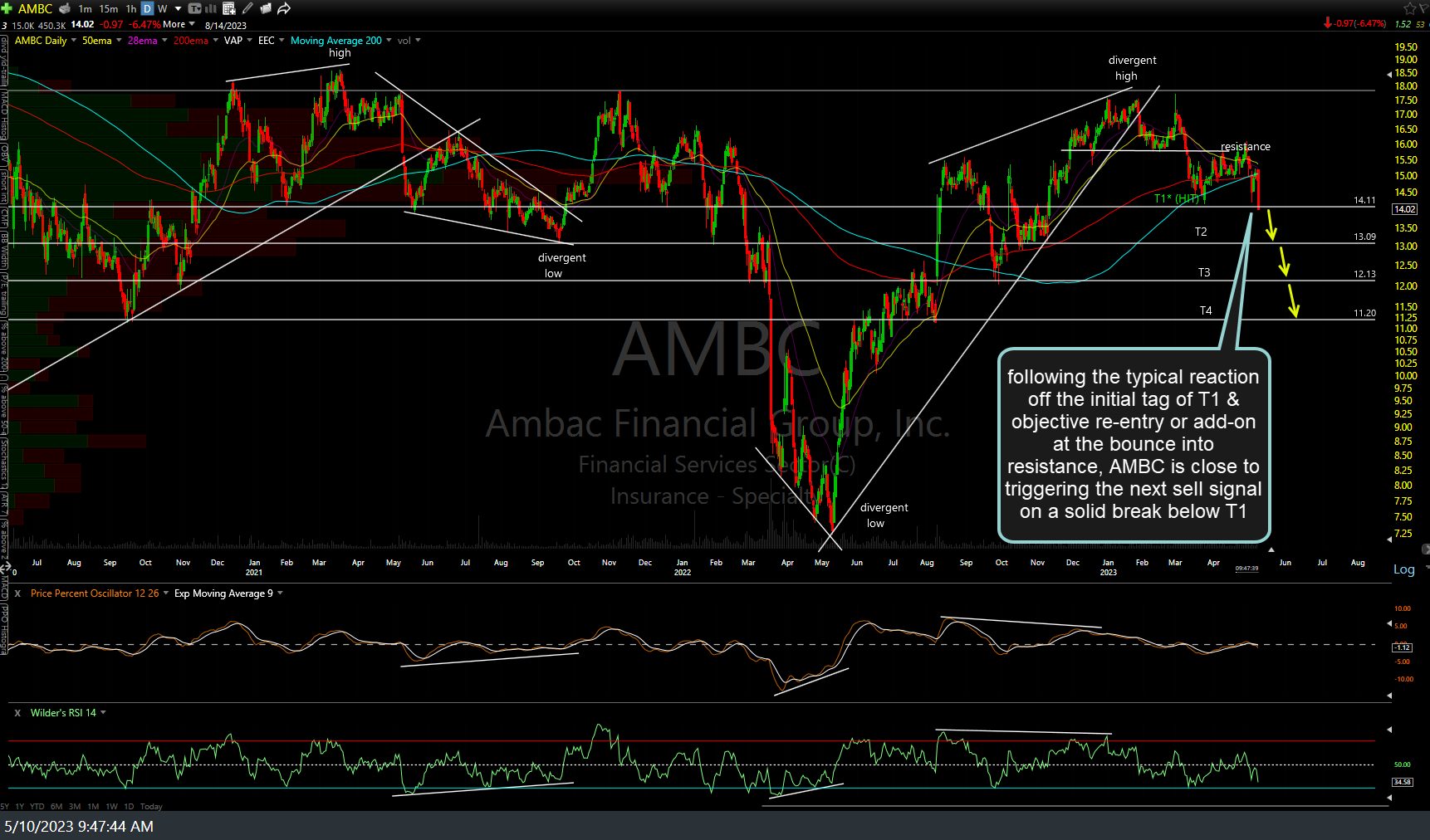

Likewise, following the typical reaction off the initial tag of T1 & objective re-entry or add-on at the bounce into resistance, AMBC (Ambac Financial Group) is close to triggering the next sell signal on a solid break below T1. Initial & updated daily charts below.

Although not an active trade, I’m watching AGO (Assured Guaranty, another one of the largest municpal bond insurers) for both a sell signal/objective short entry on a break below 45 as well as clues to any building issues with the muni bond market. Daily chart below.

I’ll continue to monitor the various credit/bond markets (i.e.- Treasuries, investment grade corporate bonds, junk bonds, fallen angels, credit spreads, etc.) as well as various financial sub-sectors (insurance, private equity, broker/dealers, etc..) for the next potential shoe to drop as all most eyes still remain on the banking sector.