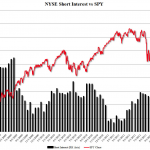

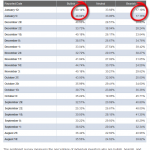

Investor sentiment can often be used successfully as a contrarian indicator but only when at or near extreme levels. There are various sentiment measures including the Put/Call ratio, the $VIX (volatility index), short interest, and of course, sentiment survey’s conducted (usually on a weekly basis) of whether investors are bullish, bearish, or neutral. Regardless of which measure is used, the premise is the same: Historically, when bullishness and/or bearishness has reached extreme levels, a reversal of the current trend (whether just a correction or primary trend reversal), is often not too far away. Once again, no one indicator works 100% of the time and using sentiment as a contrary indicator is far from an accurate timing indicator, as extreme bullish or bearish sentiment can get even more extreme. Also realize that stocks and markets as a whole often experience very large price gains just before they peak (think tech bubble going into March 2000 or view a 10 yr chart of NFLX). Again, elevated or extreme sentiment measures don’t always give timely trend reversal or correction signal but taken in context with other indicators, may help you position yourself in advance for a reversal, tighten stops, take profits and/or avoid entering new positions that are in-line with a prevailing trend that’s in it’s final stages, etc.. Here’s a few charts.