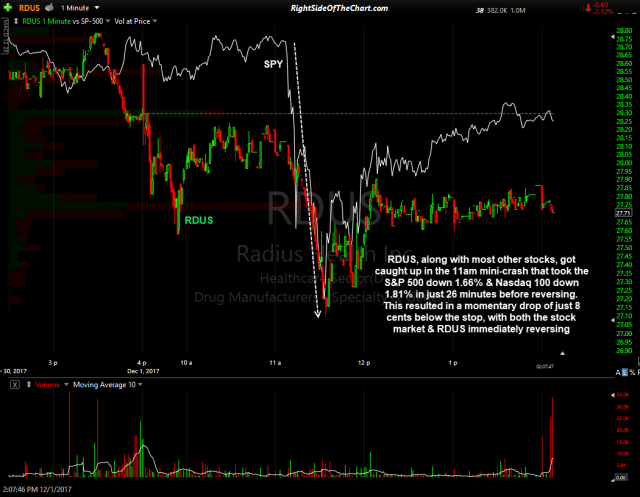

The RDUS (Radius Health) swing trade, along with most other stocks, got caught up in the 11am mini-crash that took the S&P 500 down 1.66% & Nasdaq 100 down 1.81% in just 26 minutes before reversing. This resulted in a momentary drop of just 8 cents below the suggested stop, with both the stock market & RDUS immediately reversing. As that selling was not related to the company, RDUS will be added as another, new Active Long Swing Trade here just above the 27.50ish support.

- RDUS vs. SPX 1-min Dec 1st

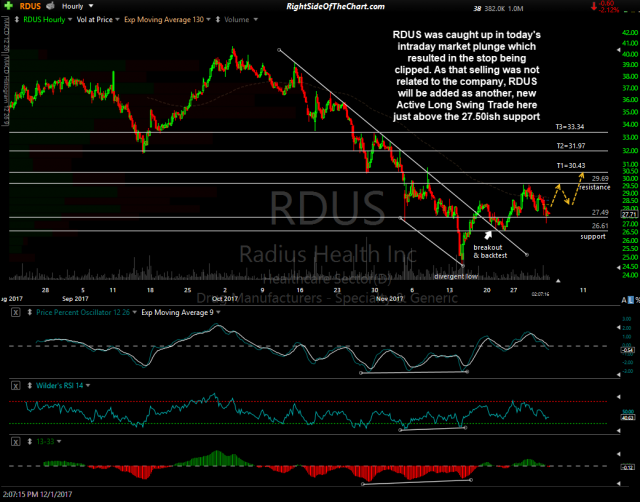

- RDUS 60-min Dec 1st

Stop-runs on a trade that still looks promising are one of the potential pitfalls of using stop-loss orders vs. mental stops during periods of increased volatility. The loss for the stopped out trade is 5.4%. The new trade offers an objective entry around current levels (27.71) down to but not below the 27.49 support level & as high as 29.00, although stops & price targets should be calculated using an favorable R/R based on one’s entry price. Price targets remain the same as the previous trade (30.43, 31.97 & 33.34) as does the suggested stop (any move below 27.19) & the suggested beta-adjusted position size (0.90).