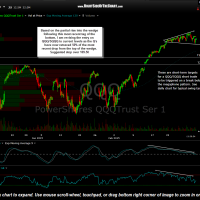

Based on the partial rise into the wedge following this most recent tag of the bottom, I am revising the entry on QQQ/SQQQ to current levels as the Q’s have now retraced 50% of the most recent drop from the top of the wedge, with a suggested stop over 109.50.

Some of you might recall the previous short entry on the SPY back on Sept 24th that was also based on a partial rise into a broadening wedge pattern on the 60 minute chart. The reasoning behind the partial rise short entry was explained in detail in the video posted that day, along with what also proved to be a nearly perfect entry on a swing short in GDX back in 2012. Again, the methodology for establishing a long or short position on a partial rise is discussed in the video link above and the original 60 minute chart from that entry as well as the 60 minute chart posted when the final short-term (60 minute) target was hit are shown below, along with the updated 60 minute chart of QQQ.

To summarize from the comments on those previous trades, partial rise entries don’t necessarily have a very high chance of being successful. However, they do provide an excellent risk-to-reward ratio as your stop is placed relatively close to entry yet the profit potential, should prices reverse and go on to break down below the bottom of the wedge pattern, is typically many times what you risk losing if stopped out. With that being said, more conservative traders might still opt to wait for a breakdown below the pattern before establishing a partial or full position. QQQ & SQQQ will now be added to the Active Trades-Short category and remain as Short Setups for now as well.

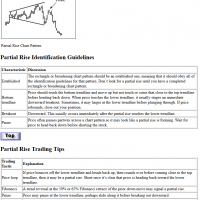

- Partial Rise Trading Strategy

- SPY 60 min Oct 10th

- SPY 60 min Ascending Broadening Top Strategy

- QQQ 60 minute 2 March 4th