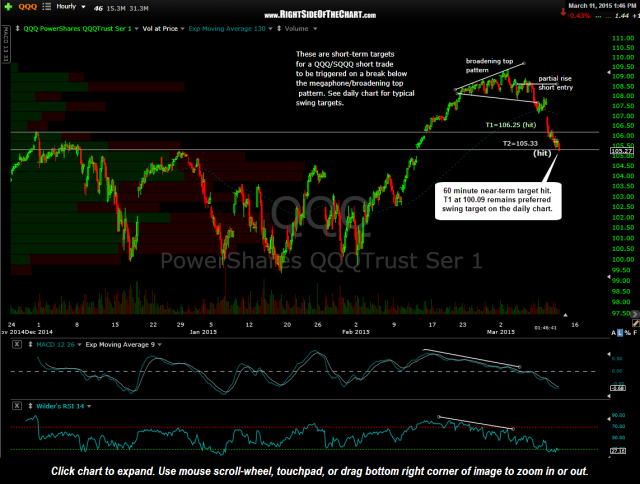

The 60 minute near-term target, T2 at 105.33, has now been hit. T1 at 100.09 remains preferred swing target on the daily chart. As stated yesterday, my expectation is that the selling will continue to accelerate in the coming days. I had also recently mentioned that my expectation was that the T1 level will be reached on or around April 23rd, which is where the 100 horizontal support level and uptrend line intersect. To be more accurate, I should have stated that my expectation for T1, which was actually listed as the first of the uptrend line OR the 100.09 level, which ever comes first, will likely be hit on or before April 23rd as it is quite possible that the 100 horizontal support level is hit before the downtrend line.

Of course that is my best guesstimation of not only where QQQ prices are going in the future but also when they will get there as well so take it fwiw. My point is to revisit the fact that for those that opted to use SQQQ (3x short Nasdaq 100 Index etf) for the 60 minute price targets, as the profit potential for the move down in the QQQ was much smaller than my usually trades and expected to be hit relatively quickly (as it did, with the short entry exactly a week ago today), might now consider rolling into one of the aforementioned $NDX trading proxies such as QQQ, QID, or NQ e-minis. Keep in mind that QQQ put options are most likely less attractive at this point then just a few days ago with volatility premiums increasing along with the recent selling.

As stated before, the SQQQ (3x short of the QQQ) trade will now be considered completed but QQQ will remain on as an Active Short Trade until either the final swing target is hit or the trade is stopped out (revised stops to follow). Should you decide to continue to hold SQQQ, maybe consider a trailing stop at this point which will help continue to build on your gains, should the Q’s keep falling with relatively minor counter-bounces, while also minimizing the tracking decay suffered by 3x leveraged etfs caused each time prices close in the opposite direction of your trade.