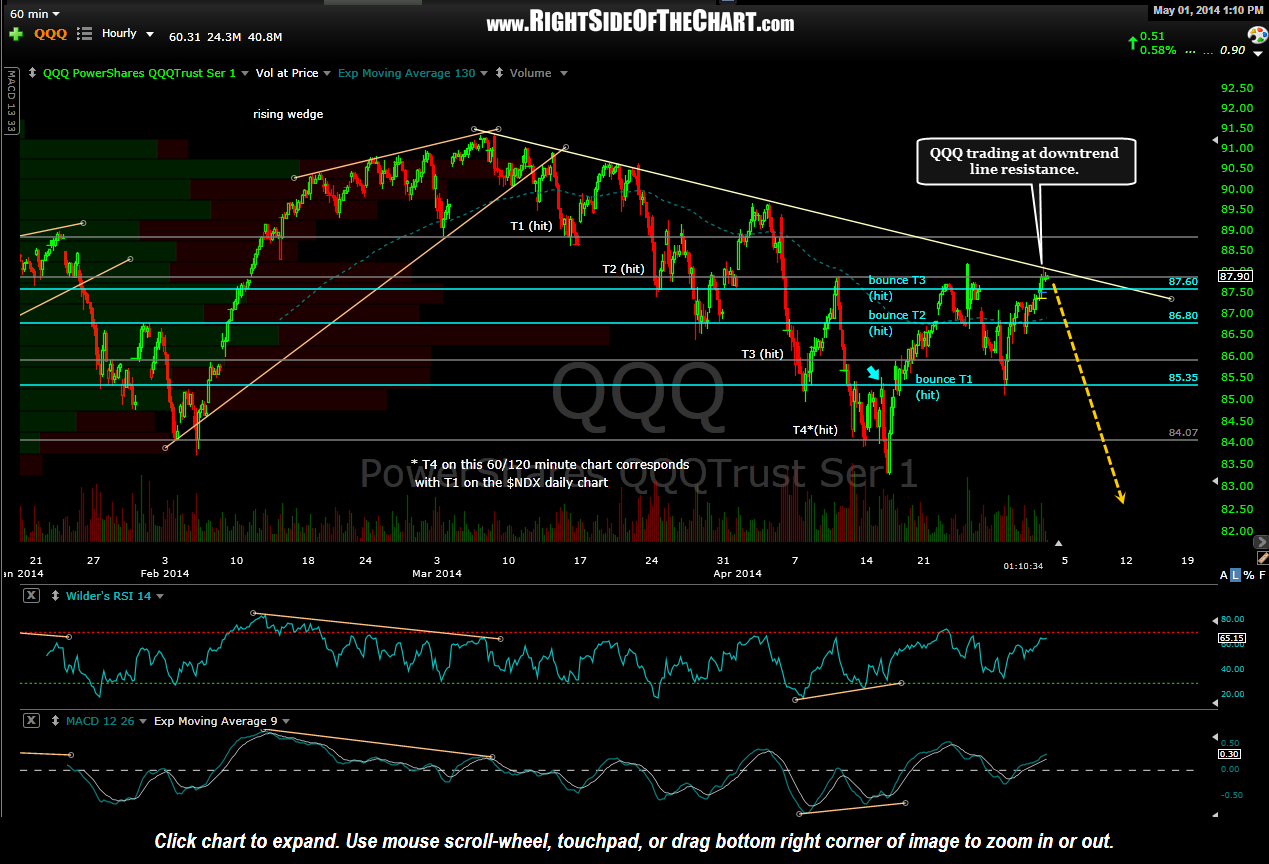

We still have a mixed bag on the technicals of the US markets and my focus remains primarily on the Nasdaq 100 at this time. The $NDX/QQQ remains on an intermediate-term downtrend by just about all metrics that I use at this time although that can & likely will change should the recent short-term uptrend continue well into next week. As of now, the QQQ is challenging that downtrend line shown on the last couple of QQQ 60 minute charts.. My primary scenario would have prices turning down at or slightly above this level, maybe around the 61.8% Fibonacci retracement of the previous leg down which comes in around 88.30 (Fib levels not shown on this chart).

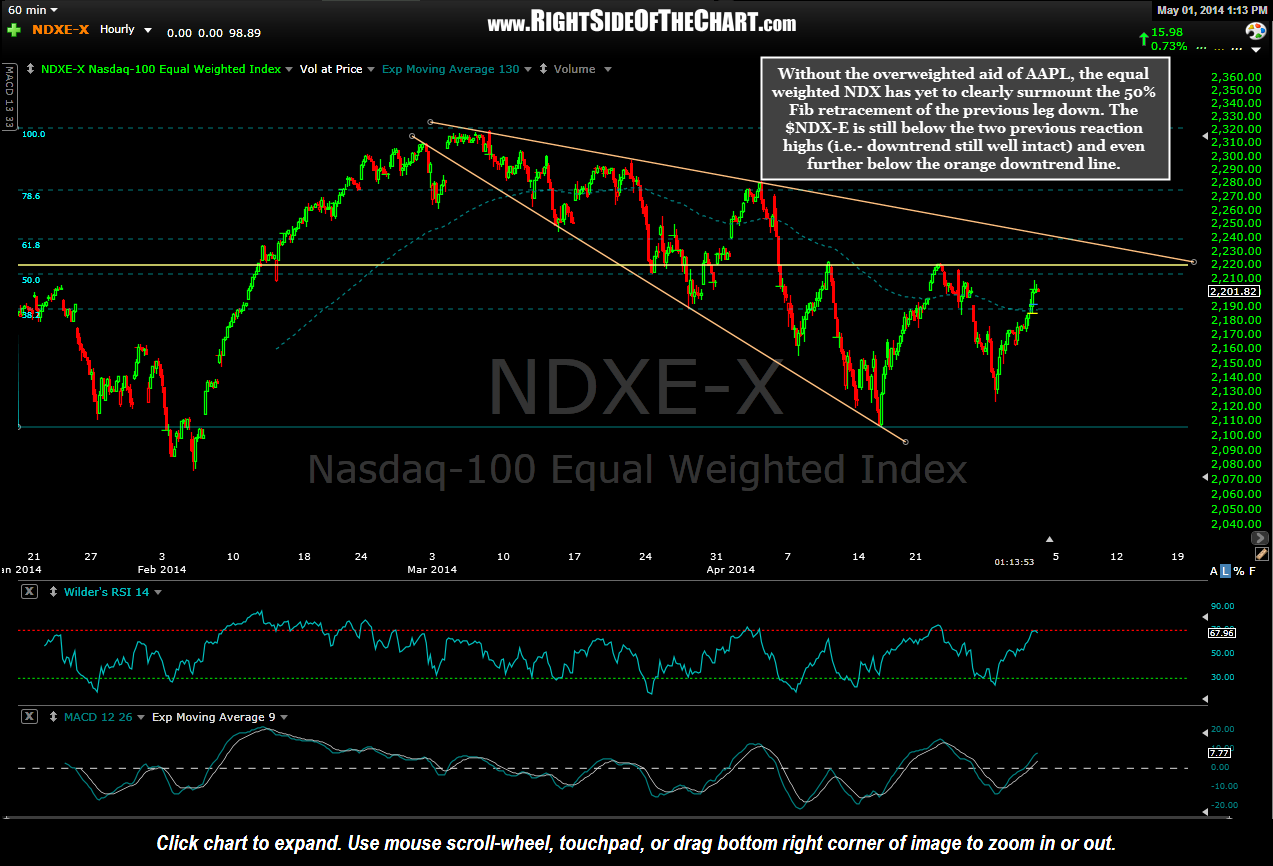

As recently highlighted, the $NDX-E (Nasdaq 100 Equal Weighted Index), without the added boost that the AAPL top-heavy $NDX has, continues to lag on this bounce. In fact, the $NDX-E remains below the 50% Fibonacci retracement of the previous leg down and well below its comparable downtrend line. Bottom line is that we continue to have a mixed bag in the US markets with the $SPX & $DJIA holding up relatively well but the $NDX & $NDX-E still within a confirmed intermediate-term downtrend for now. My preference will be to continue to keep things light until the near-term outlook for the markets becomes more clear, which will probably not happen until at least next week.