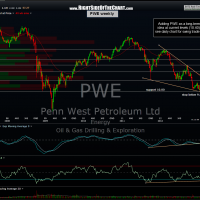

PWE was a successful long trade on the site late last year. The stock is once again offering what looks like a nice R/R long entry at current levels for both swing traders as well as longer-term traders & investors. The current yield of 10.50% is an added sweetener to this one as well (assuming the dividend is not reduced).

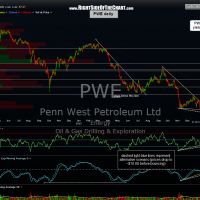

Typical swing traders might prefer to use the targets shown on the daily chart while longer-term traders/investors might prefer the targets listed on the weekly chart below. Make no mistake about it; PWE is and has been in a major downtrend since early March of 2011. However, as with the previous trade entered back on July 19th, 2012 there are strong divergences setting up on both the daily & weekly time frames and I believe that the odds for at least a tradable counter-trend bounce are very good at this point, if not more lasting trend reversal (i.e.- a bottom in the stock).

Based on my analysis of the charts, I’d put nearly equal odds on one of two scenarios playing out from here: 1) PWE reverses very soon, from at or just below current levels, going on to break out of the falling wedge pattern shown on this daily chart and continuing to move higher over time OR… 2) I could also see the stock continue to drift lower over the next few weeks or so down to around that 10.00 weekly support level, especially if the long overdue market correction takes place. Even if the latter plays out, assuming that support holds, the positive divergences on these time frame would still be intact and this trade would still look promising. Therefore, one might consider scaling into a position of PWE starting around current levels with the intent to add to the position on either a move down to the 10.00 area (with a stop below 9.88 or whatever level is commensurate with your own risk tolerance, trading style and preferred profit target(s).) Of course you would also continue to add to the position if the stock were to move higher from currently levels, ideally once the daily downtrend/wedge line is taken out.

PWE will be added an both a trade setup and active trade at current levels (10.40) and I plan to mention a 2nd entry on either a move down to the 10.00 area or a break above the daily downtrend line. It will also be added to the Long-Term Trades category which I am considering re-naming “Investments” or something along those lines to avoid confusion. A description of each trade idea category can be found by clicking on the shaded category box under “Trading & Investment Ideas” on the top menu of the site.