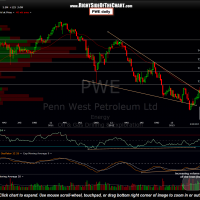

After climbing 22% from since breaking out above the daily rising wedge pattern exactly one month ago today, the PWE long trade was up as much as 22% on Tuesday, coming within 20 cents of it’s first target before getting dragged down, kicking & screaming, with the broad market. Although this remains one of my favorite (and very few) long trades, PWE, like most longs, even those with bullish chart patterns, will likely get taken down with the herd.

Today, the stock kissed (to the cent) the top of that former minor resistance area that I had highlighted in the recent updated before mounting a small bounce and closing just above that support level (once resistance is broken it becomes support). Therefore, any solid move or daily close below that level would be the first objective stop level for part or all of the position for those long. I’ve also added two additional horizontal support levels as well as an uptrend line (all in white) which could be used as additional stop levels for those long. I still hold a full position of PWE and my personal plan is to scale out of the position, should it continue lower, using partial stop-loss orders below each of these support levels. Daily & weekly PWE charts below:

Regarding the additional active long trades on the site, there are a couple that I’m considering removing as well as a couple that have already exceeded their suggested stop criterion and will be removed asap. As crazy as it sounds, some of those low-quality, low-priced shipping stocks still look fine technically as of now although again, a significant broad market sell-off is likely to take the good down with the bad & the ugly.