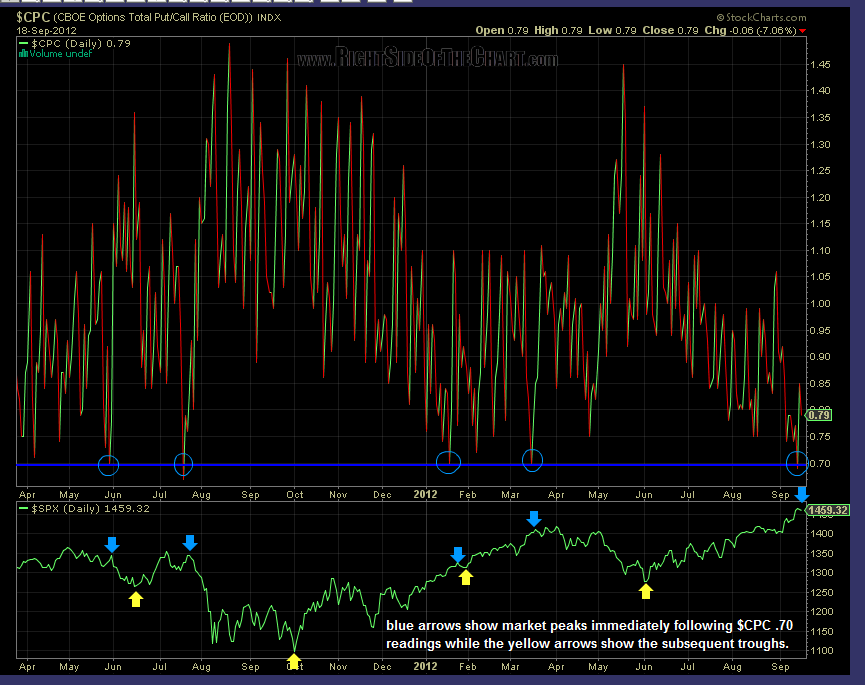

another reason the odds for a significant correction remain elevated is the recent plunge in the $CPC (put/call ratio). i will admit that the track record for shorting readings of .70 or below is a bit spotty, especially when you go back several years (this chart shows the last 18 months). however, although a major correction did not follow every single reading of .70 or below, every major correction over the last several years WAS preceded by a reading of .70 or lower. bottom line, just one more red flag & indication that the odds of a significant correction are elevated at this time.