As with the recently posted AUQ & SSRI mining stock trades, yesterday’s long entries on both SIL (Silver Miners ETF) as well as GDX (Gold Miners ETF) have the potential to morph into longer-term swing trades with the possible addition of one more more price targets at higher levels. As of now these remain only potential targets as we need to see confirmation from the charts. At this time, the potential certainly exists for a continued move higher but as mentioned earlier, it would be unlikely to see the miners continue to rally much further without the metals themselves (gold & silver) also moving higher. Yes, there are occasional periods of disconnect between the metals and miners but that is much more the exception than the rule. Trading is all about taking trades where the odds are clearly weighted in your favor and when trading the mining stocks, it is best to align those trades in the direction of the metal.

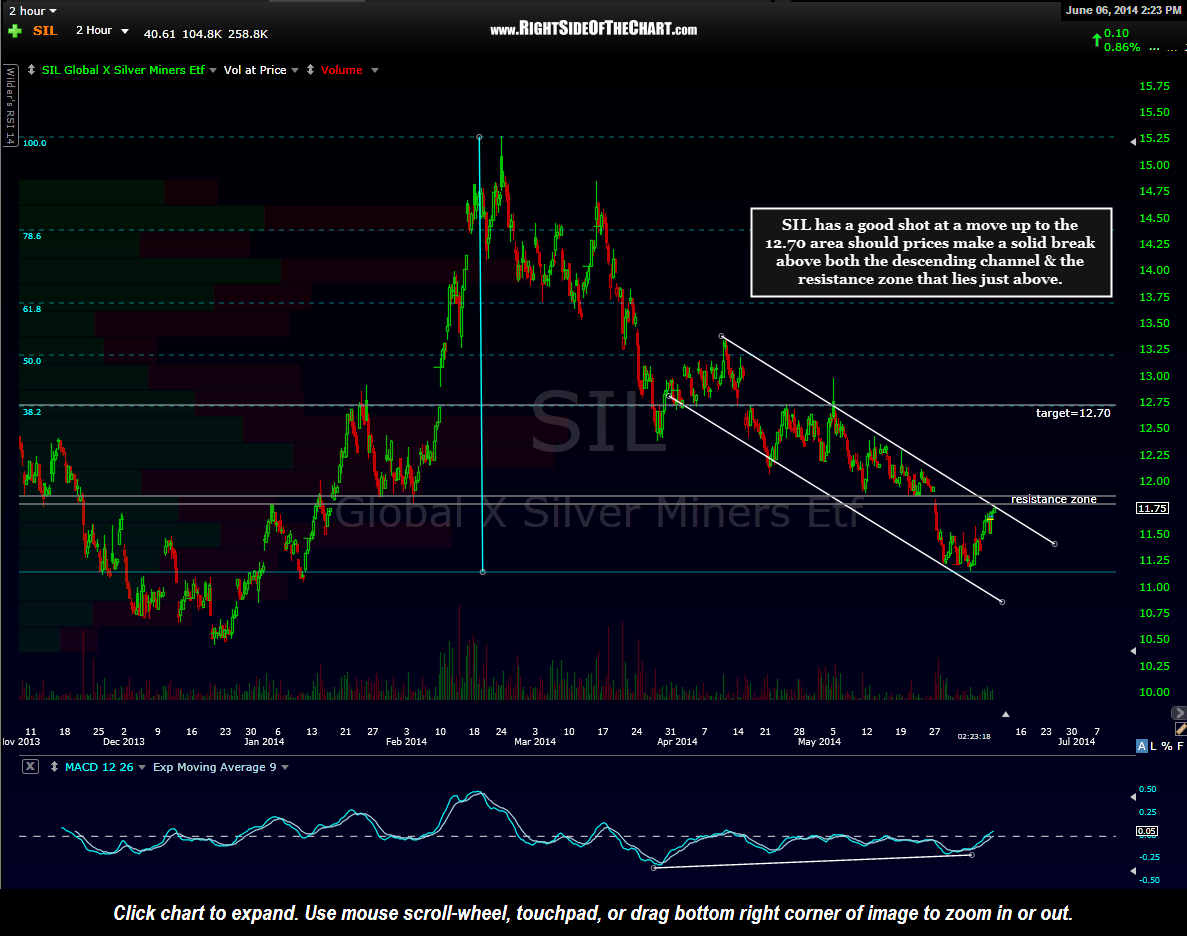

With that being said, other than a reversal in the near-term downtrend in gold & silver, a break above this descending channel in SIL as well as the resistance zone which lies just above would likely be the catalyst for a move to the 12.73 area, which is not only a well-defined horizontal resistance level, defined by two very large gaps and numerous reactions, but also the 38.2% Fibonacci retracement level of the sharp move down from the Feb highs into the recent lows. Intersecting resistance levels & key Fib retracements are often like a magnet for stock prices. First things first though and that would be a solid break above the aforementioned resistance zone. I wanted to share the fact that these targets may be extended as the current SIL long is already within a few cents of the sole price target (11.80) posted on the 15 minute chart since the first (aggressive) entry was triggered just yesterday. As the charts are dynamic, so are my trading plans, hence, the reason that I will occasionally extend price targets on a trade or book profits and remove a trade before a target is hit. One option for those wanting to hold out for additional upside beyond the 15 minute target would be to raise stops to protect profits (somewhat slightly below today’s open would be objective) while letting the position ride.