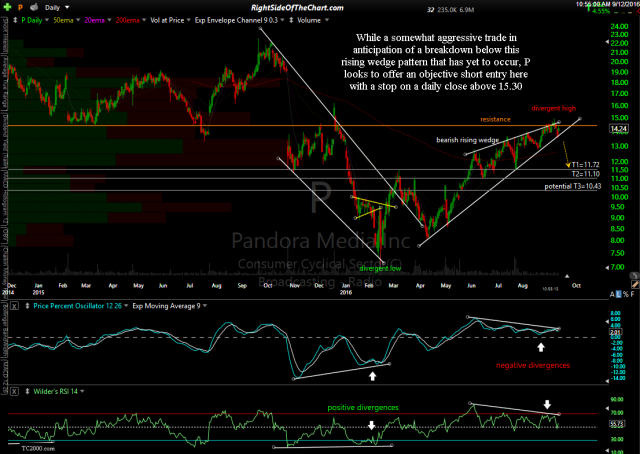

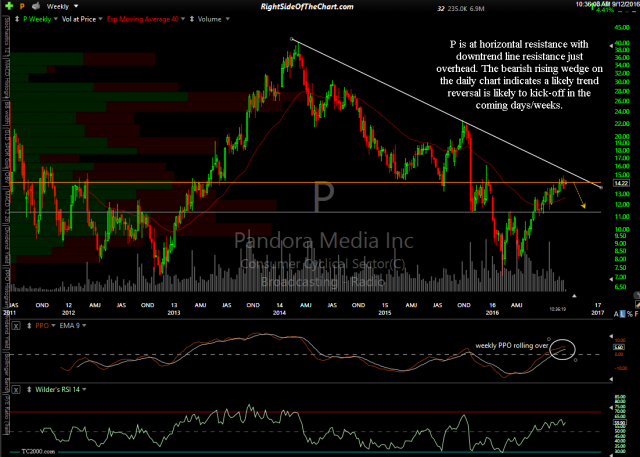

While a somewhat aggressive trade in anticipation of a breakdown below this rising wedge pattern that has yet to occur, P (Pandora Media Inc) looks to offer an objective short entry here with the current price targets of T1 at 11.72, T2 at 11.10 & a potential *T3 at 10.43 (*TBD depending on how the charts of P & the broad market develop going forward. The maximum suggested stop is a daily close above 15.30. P is at horizontal resistance with downtrend line resistance just overhead. The bearish rising wedge on the daily chart indicates a likely trend reversal is likely to kick-off in the coming days/weeks.

- P daily Sept 12th

- P weekly Sept 12th

Shorting a stock while still inside a bearish rising wedge pattern as well as in a solid uptrend in anticipation of a breakdown that has yet to occur is an aggressive, counter-trend strategy. More conventional traders that like the setup might opt for a confirmed break below the wedge pattern as well as additional bearish confirmation in the broad market, such as a break below today’s lows. Another strategy would be to take a starter (fractional) position here, adding to the position if/when Pandora breaks below the wedge pattern. The Suggested Beta-Adjustment for this trade is 0.75.