The P (Pandora Media Inc) short trade gapped below T1 to open at 11.15 yesterday, where any standing BTC limit orders set at T1 would have been executed, providing a 21.7% profit on the trade. As T1 was previously revised to be the final price target, P will be moved to the Completed Trades category. The updated daily chart is below, followed by the two previous daily charts associated with this trade.

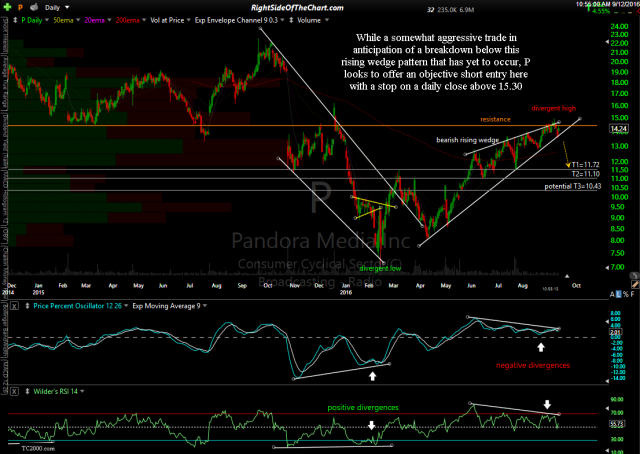

- P daily Sept 12th

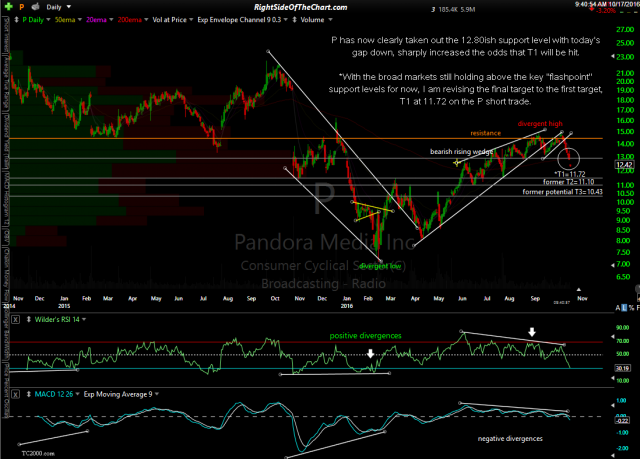

- P daily Oct 17th

As posted earlier today, I am in the process of updating the official trade ideas on the site. Several updates have been made so far with more to come. Although all of the updates will be posted on the front page of Right Side Of The Chart, email notifications when the updates are published will only be sent out on time sensitive trades, such as P which just hit the final target yesterday & is still trading close to that level. As such, you may want to periodically check the front page of the site for any trade updates & I hope to have all of the official trades updated before the weekend with new trade ideas to follow.

Just to clarify, when an active trade gaps above or below a price target or maximum suggested stop-loss level, the opening price of the gap is used in the gain or loss calculation as any standing limit orders would be filled at the open on the morning of the gap. Limit orders (buy-to-cover limits on short trades or sell limit order on long trades) are essentially converted into a market order once the limit price has been hit or exceeded, meaning that they can only be filled at the limit price OR a more favorable price, if the stock has bypassed the limit order.

I find it best to use limit orders for my profit targets and stop-loss orders (not stop-limit orders) for my stops, as a stop-limit order can & will be bypassed and not filled if the stock gaps or moves very quickly beyond it before it can be filled. As such, stop-limit orders potentially allow your losses on the trade to continue to build indefinitely until you cancel & replace the order to close the position.