@mikeflegel asked for an update on NVDA (NVIDIA Corp), which reported earnings last night so I figured I’d share my reply as a homepage post for those interested.

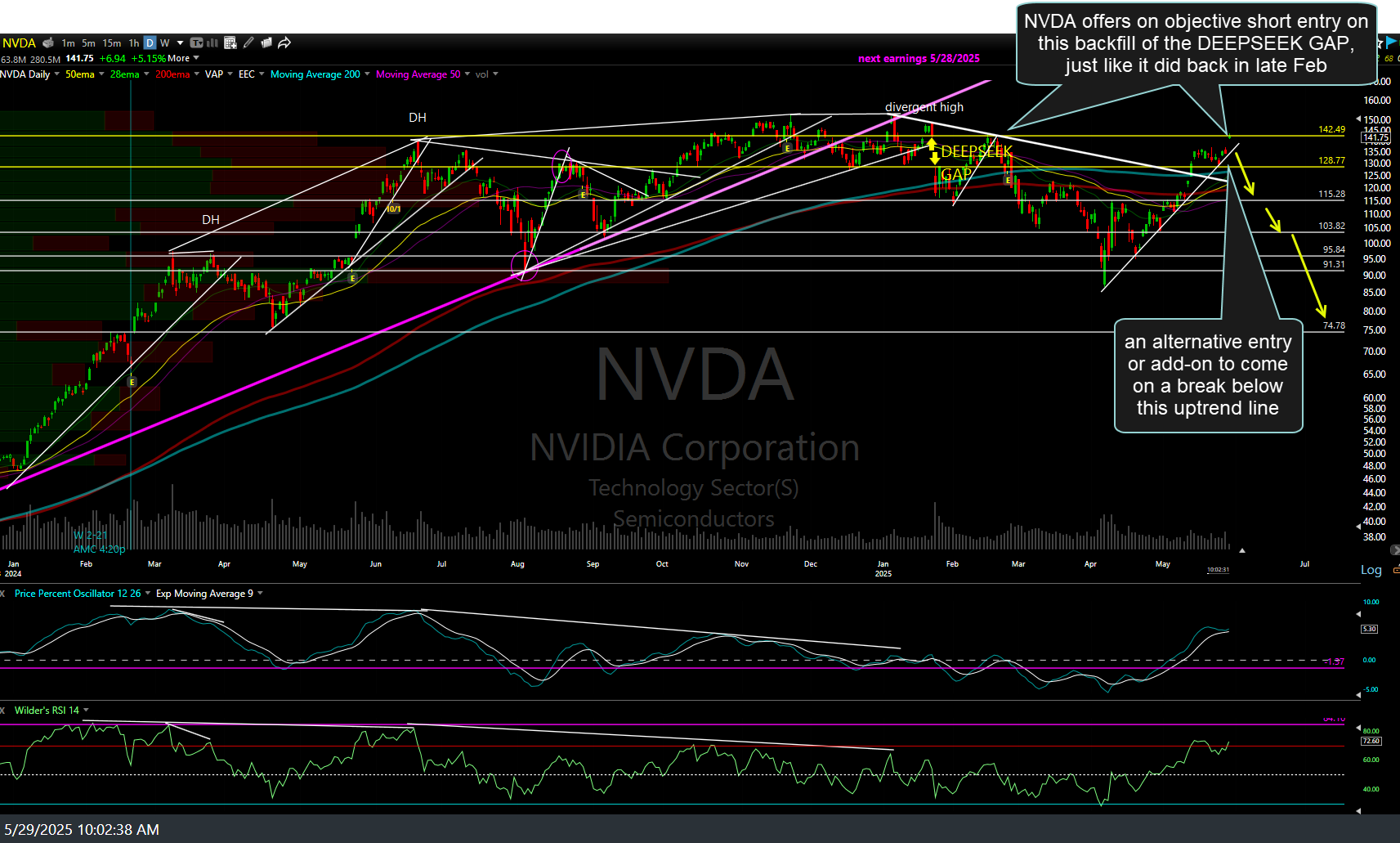

On today’s relatively muted bounce (compared to previous post-earnings moves), NVDA is right back to where we shorted it on Feb 20th on the backtest of the top of the very technically significant DEEPSEEK GAP, with the stock immediately falling 37% from there. (that Feb 20th chart followed by the updated daily chart below).

The negative divergence on the 60-minute chart has continued to build on today’s post-earnings pop so watch for a solid break below that uptrend line to trigger a sell signal (although shorting here at resistance is also objective).

As with the broad market, the near-term trend remains resilient but that doesn’t change the technical posture of these charts nor the fact that the R/R (risk-to-reward ratio) for shorting NVDA here at key resistance with a stop somewhat above ranges from “very good” to “phenomenal”, if targeting the any or all of my remaining longer-term trend targets (T2 is next as T1 was already hit twice & where we covered & reversed to long (both times)). Weekly chart below.