NUGT (3x bullish gold miners ETF) will be added as an official SHORT trade here at 50.81 with a suggested stop above 55.60. These two priced targets are subject to changed based on the GDX chart.

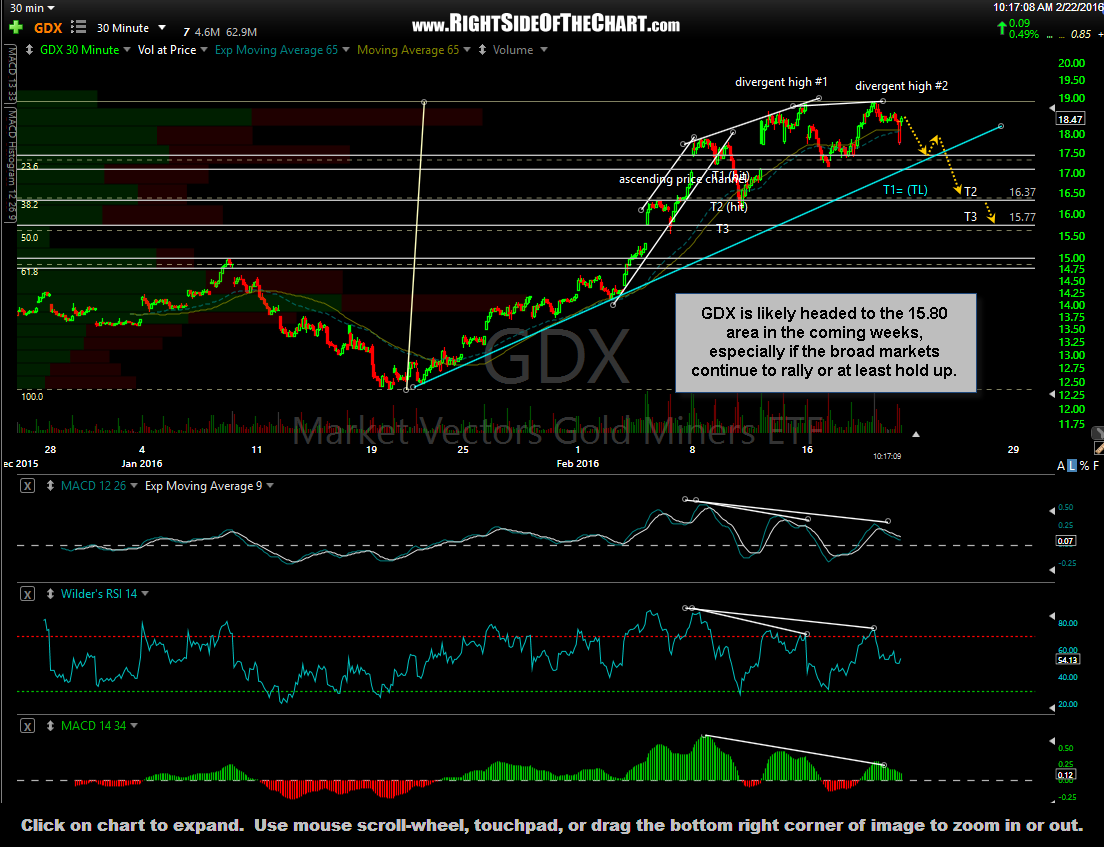

GDX (1x gold miners ETF) is likely headed to the 15.80 area in the coming weeks, especially if the broad markets continue to rally or at least hold up. GDX has been moving higher within this bearish rising wedge pattern while recently printing a double-top high with double (2 consecutive) negative divergence in place. NUGT will be the preferred proxy for a GDX short as the miners are likely to experience some choppy price action in the coming weeks which would exacerbate the price decay suffered by DUST & NUGT. Therefore, if the miners move down or even trade sideways for a while, this decay would work in favor of a NUGT short trade while against a DUST long trade.

This is clearly a counter-trend trade which makes it aggressive. Factor that in to the 3x leverage AND the fact that the gold mining stocks can easily rise or fall over 5% in any given day and the importance of properly beta-adjusting your position size can not be over-emphasized (assuming this trade even fits your risk tolerance & trading style to begin with).