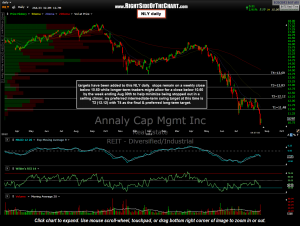

Price targets have been added to this NLY daily. Stops remain on a weekly close below 10.60 while longer-term traders might allow for a close below 10.60 by the week ending Aug 30th to help minimize being stopped out in a selling climax. My preferred intermediate-term swing target at this time is T2 (12.12) with T4 as the final & preferred long-term target.

Price targets have been added to this NLY daily. Stops remain on a weekly close below 10.60 while longer-term traders might allow for a close below 10.60 by the week ending Aug 30th to help minimize being stopped out in a selling climax. My preferred intermediate-term swing target at this time is T2 (12.12) with T4 as the final & preferred long-term target.

For anyone interested in this trade, here are my thoughts on the stock in reply to an inquiry that I received on it last night:

In what’s probably an over simplistic explanation; yes, my NLY long entry takes into consideration potential interest rate changes, sentiment, dividend cuts, etc… With around a 15% dividend yield from where I the trade was added yesterday and even a 70%+ reduction in the dividend, not that I believe that is likely to happen, would still render NLY with a very attractive yield. I also factored in the valuation as the stock has a p/e ratio of just over 3 vs. a 5 yr historical average (assuming my source is correct) of 39. However, the most important determination in my decision, as simple as it sounds, is based off my analysis of the chart.

After graduating with a business degree, I embarked on a 13 year career as a stockbroker. My education from both focused almost exclusively on fundamental analysis. About 10 years ago, I started to become enlightened with the “magic” of technical analysis and embarked on a passionate quest to learn all that I could about it. Essentially, I’ve found that fundamental analysis (reading companies quarterly reports, income statements, analysts opinions & forecast, etc…) was more akin to driving while looking in the rear-view mirror than out the windshield. By the time you read or hear just about anything from the mainstream media or via acquaintances, that information has already been priced into the stock by those in the know or whatever other powers-that-be.

With that being said, I don’t care how bullish a case I can build on NLY right now (and fwiw, I think that there’s a pretty solid one right now although I will admit I did very little due diligence on the stock from a fundamental perspective), if the stock fails to hold this weekly support area of around 10.60ish by the end of this week, possibly next, then I will simply exit the position at a loss and look to buy it again later if the charts tell me to. TA (technical analysis) is not the holy grail but I do believe that it does a much better job of forecasting future price movements than does fundamental analysis, at least from the information that we as laymen are privy too (unlike the Warren Buffets of the world and some of these big hedge fund traders going down for insider trading lately).

I know that’s a long-winded answer but I hope it helps. In summary, I am bullish on the stock from a fundamental perspective while I believe that the odds that a lasting bottom will be put in around current levels are good from a technical perspective. However, if this support level is solidly broken (not just for a couple of trading sessions), then there may be other unknown (to the masses) negatives impacting the stock that could bring prices considerably lower before all is said & done. There’s just virtually no way that as popular a company that NLY is, that with all the money sloshing around on Wall Street right now, that all those big money managers are going to let such a historically well managed company paying such a high dividend at such a low valuation go much lower without stepping in at this support level soon unless there’s something really wrong under the hood.

Hope this helps & best of luck on your investments. I’m guessing that if the markets continue moving lower over the next few weeks to months (my primary scenario) then we will see a flight to safety with money moving back into treasury bonds, which should drive rates down & give a boost to that basket of MBS stocks that you hold.

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]