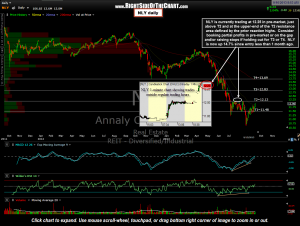

NLY is currently trading at 12.25 in pre-market, just above T2 and at the upper-end of the T2 resistance area defined by the prior reaction highs. Consider booking partial profits in pre-market or on the gap and/or raising stops if holding out for T3 or T4. NLY is now up 14.7% since entry less than 1 month ago. My plan is to book partial profits here in pre-market as the odds of a reaction (pullback or consolidation) are fairly high while raising my stops on the remaining shares. I also plan to buy back into a full position either on a pullback or if the upper-level of the T2 area (12.25ish) is clearly taken out, preferably after some consolidation in order to work off the near-term overbought conditions. Updated daily chart showing Friday’s closing prices with a 1 minute streaming chart with the pre-market trades overlaid:

NLY is currently trading at 12.25 in pre-market, just above T2 and at the upper-end of the T2 resistance area defined by the prior reaction highs. Consider booking partial profits in pre-market or on the gap and/or raising stops if holding out for T3 or T4. NLY is now up 14.7% since entry less than 1 month ago. My plan is to book partial profits here in pre-market as the odds of a reaction (pullback or consolidation) are fairly high while raising my stops on the remaining shares. I also plan to buy back into a full position either on a pullback or if the upper-level of the T2 area (12.25ish) is clearly taken out, preferably after some consolidation in order to work off the near-term overbought conditions. Updated daily chart showing Friday’s closing prices with a 1 minute streaming chart with the pre-market trades overlaid: