Several new charts have been added to the Live Chart Links page including several new global stock indices as well as some gold & silver mining stocks which appear to be setting up in potentially bullish chart formations. Most of these charts are marked with basic trendlines and horizontal support & resistance levels with prices targets as well as additional annotations to be added in the coming days & weeks as well as some additional trade ideas in the mining sector.

Several new charts have been added to the Live Chart Links page including several new global stock indices as well as some gold & silver mining stocks which appear to be setting up in potentially bullish chart formations. Most of these charts are marked with basic trendlines and horizontal support & resistance levels with prices targets as well as additional annotations to be added in the coming days & weeks as well as some additional trade ideas in the mining sector.

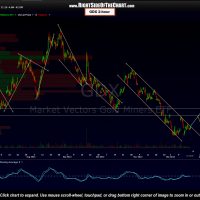

As I’m still leaning towards a marginal new low (below the late June lows) in gold prices, as well as many of the mining stocks on my radar, I will hold off on adding any new Active Trades in the mining sector at this time unless I see a well-defined and objective entry on any specific mining stocks. As with the Gold & Silver Stocks post made back on June 26th, the very day the mining sector hit a major bottom before gaining roughly 40% from there, my preference will be to use a ‘shotgun’ approach of scaling into the most promising individual stocks within the mining sector although one could also use GDX as a proxy and more diversified vehicle for trading or investing in the sector. My best guess would be that the sector may continue to drift lower or chop around until sometime around mid-January but with a lot of eyes on the sector right now and gold so close to that long-term uptrend line, in addition to the gold stocks coming off extreme oversold readings with bullish divergences in place on the weekly charts, I wouldn’t be surprised to see the gold stocks begin to move higher before the metal.  This 2-hour GDX chart shows a couple of likely near-term scenarios, should GDX make a solid breakout above this most recent descending channel:

This 2-hour GDX chart shows a couple of likely near-term scenarios, should GDX make a solid breakout above this most recent descending channel: