In the recent MLP & Energy Sector Trade Ideas video posted on December 11th, I spent the bulk of the video highlighting bullish trade setups in various natural gas stocks & ETFs while also covering a few natural gas utility companies that appears poised for imminent corrections. The first chart of each stock below is the screenshots from that video followed by the updated charts showing just how impulsive the selling has been in those stocks.

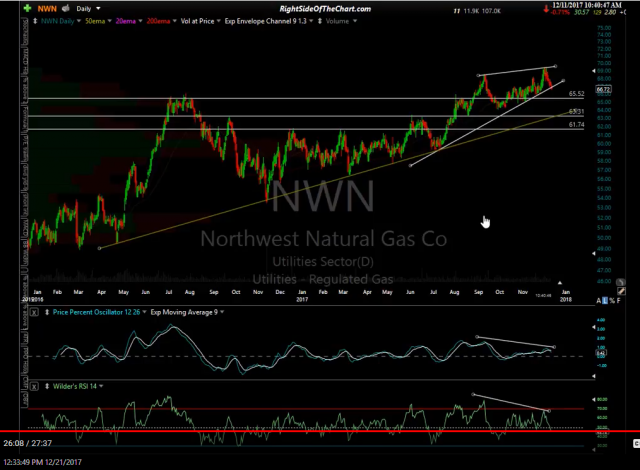

NWN (Northwest Natural Gas Co.) has plunged 12% in a near-vertical sell-off since breakdown down below the bearish rising wedge highlighted in the recent nat gas stocks video. With the stock deeply oversold & having now met the bear flag measured target, the odds for a snap-back rally are increasing sharply. However, my expectation is for a continued move down to the 57.70ish support level before all is said & done.

- NWN video screenshot Dec 21st

- NWN daily Dec 21st

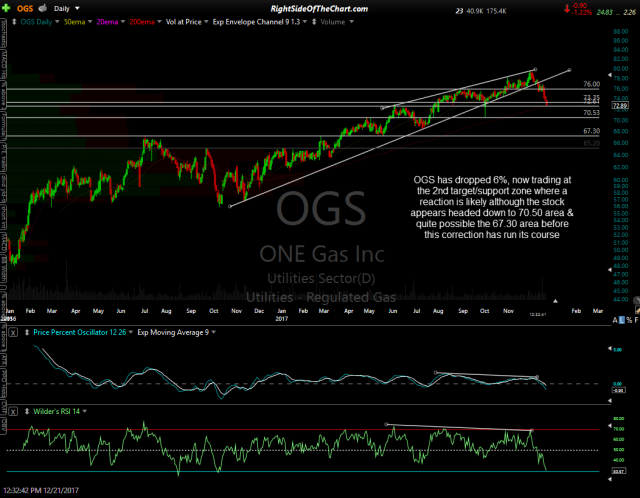

OGS (ONE Gas Inc.) has dropped 6%, now trading at the 2nd target/support zone where a reaction is likely although the stock appears headed down to 70.50 area & quite possible the 67.30 area before this correction has run its course.

- OGS video screenshot Dec 11th

- OGS daily Dec 21st

SR (Spire Inc.) went on to break down below the bearish rising wedge, as predicted in the Dec 11th video with the stock in a near vertical decent, already down 8% since then. SR has gone from overbought (70+ reading on the RSI) to oversold (30- reading on the RSI) in just over 2 weeks, a very unusual & swift drop for such a relatively low volatility utility company. The stock is also approaching support around 73.75 & as such, the odds for a snap-back rally are quite elevated at this time. As such, those that took any of these trades should consider booking profits or at least tightening stops at this point.

- SR video screenshot Dec 11th

- SR daily Dec 21st