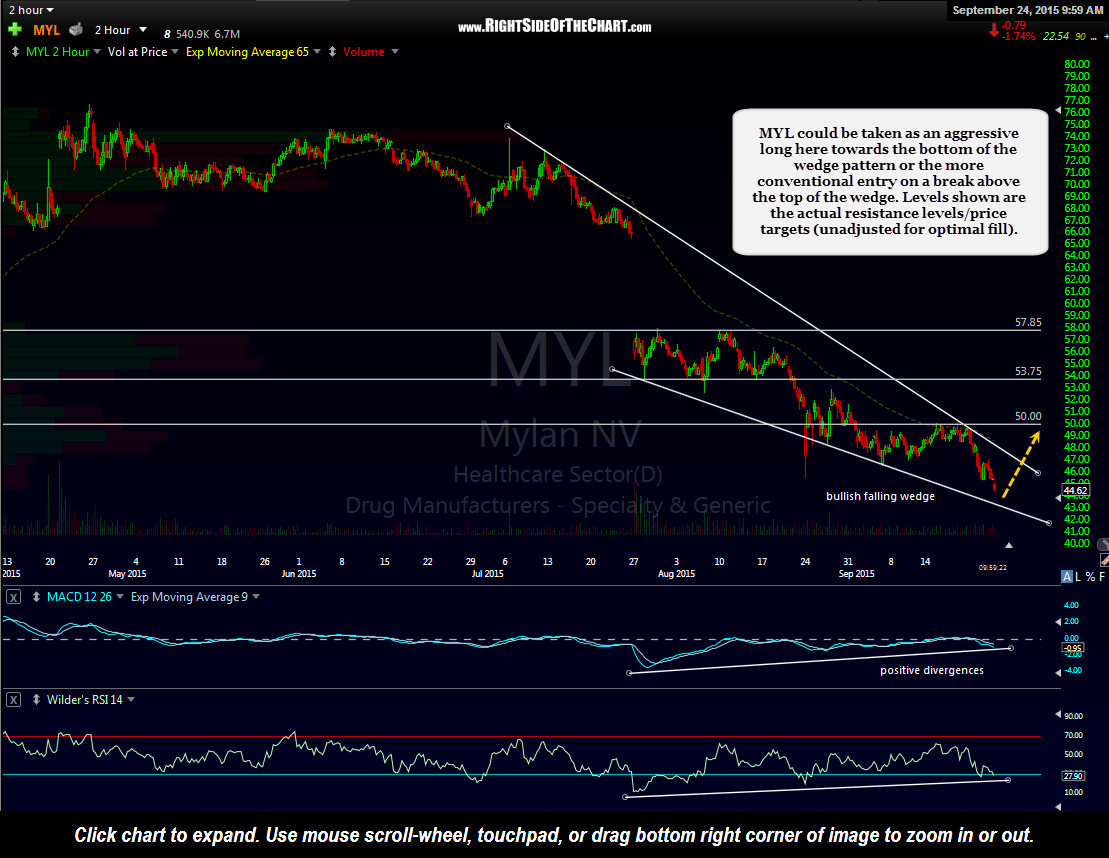

MYL could be taken as an aggressive long here towards the bottom of the wedge pattern or the more conventional entry on a break above the top of the wedge. Levels shown are the actual resistance levels/price targets (un-adjusted for optimal fills). As the number of long trade ideas on the site is lower than usual, I am going to add MYL as an Active Long Trade here while trading near the bottom of the wedge but note that this should be considered an aggressive, counter-trend trade as MYL is firmly entrenched in a bear market along with the rest of the biotech sector. I will try to post the exact suggested sell limit levels for these targets on the 120-minute chart and the suggested & official stop for this trade will be on any daily close below 41.00. The optimal entry price would be anywhere from current levels (44.62) down to around the 41.50 level, which is likely to correspond with a tag of the bottom of the wedge.

As most of you know, I have been extremely bearish on the biotech sector for months now with the biotech sector (LABU & various individual biotechs) still comprising my largest short exposure of any sector. I also continue to believe that the sector has considerable more downside in the coming months. With that being said, in order to hedge my short exposure to the biotechs, I have taken a long position in MYL. If the sector continues to fall, then MYL will most likely make a solid break of this support level & be stopped out.

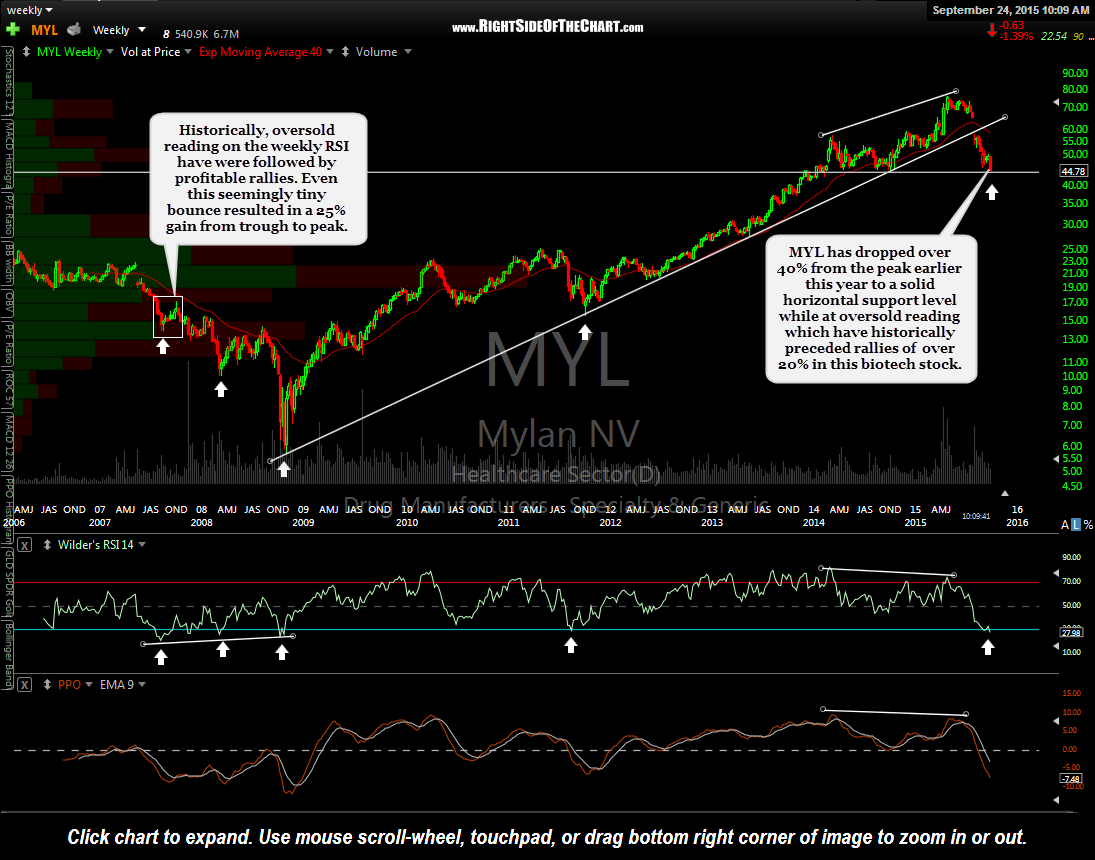

Normally, I might pass on a bullish trade setup based on only an intraday time frame when the sector is in a confirmed downtrend, such as the biotechs are but in this case, both the daily & weekly charts help to confirm a long entry. Mylan has dropped over 40% from the peak earlier this year to a solid horizontal support level while at oversold readings which have historically preceded rallies of over 20% in this biotech stock (weekly chart). The daily chart below shows that my ultimate price target, should the biotech sector confirm, would be a move up to the 57.85 area but as of now, the stock still has plenty of work to do in order to help solidify the near-term & intermediate-term bullish case.