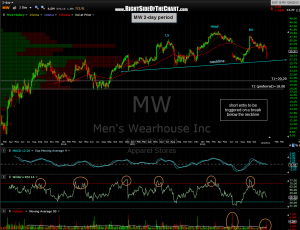

MW is setting up in what appears to be the final stages of a nice looking head & shoulders topping pattern. H&S patterns are probably one of the most widely recognized patterns in technical analysis yet most traders don’t bother to scrub the pattern for the volume criteria. From my experience, not confirming the volume patterns increases the rate of failure substantially. Ideally, you want to see impulsive selling on increased volume off both the head and the right shoulder, which is clearly the case with MW (note that large gap down on the formation of the head). Although the price action has been very choppy, this pattern also has very nice symmetry, which is another idea attribute for a H&S pattern.

MW is setting up in what appears to be the final stages of a nice looking head & shoulders topping pattern. H&S patterns are probably one of the most widely recognized patterns in technical analysis yet most traders don’t bother to scrub the pattern for the volume criteria. From my experience, not confirming the volume patterns increases the rate of failure substantially. Ideally, you want to see impulsive selling on increased volume off both the head and the right shoulder, which is clearly the case with MW (note that large gap down on the formation of the head). Although the price action has been very choppy, this pattern also has very nice symmetry, which is another idea attribute for a H&S pattern.

MW will trigger a short entry on a break below the neckline. First two targets as listed on this 2-day period chart and my current preference would be T2 (18.00), which is not only key horizontal support but also very close to the pattern measurement.