Back on December 17, 2012 I made a very comprehensive post on the fixed-income sector covering all major domestic (US) fixed-income classes: Treasuries, Municipals, Investment Grade Corporate and Low-Grade (Junk) Bonds. This gist of that post, which can be viewed here, was that the entire sector looked very bearish and that rates were were likely to rise considerably which meant that prices would fall, which has clearly been the case since then.

Although I did want to follow-up on that post as an example of how technical analysis works just as effectively on all asset class, not just stocks, the primary reason for this post is to highlight the fact that the fixed income sector is now looking to offer a very attractive risk-return profile, at least in the intermediate-term. By that I mean that I do think that we have most likely seen the bottom in a multi-decade secular bull market in bonds (bull market meaning prices rising, yields falling) and as such, rates are likely to continue to rise over the next decade+. However, in the intermediate-term (weeks to months), I believe that all the fixed income classes mentioned above with the exception of Junk Bonds (High-Yield Bonds) are offering a good risk-to-reward profile, especially when compared to the alternatives at this time such as equities.

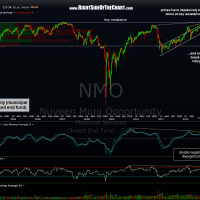

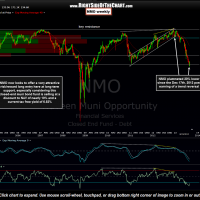

I plan to follow-up with some additional charts on the other sub-classes of fixed income soon but wanted to start with some potential swing trade candidates that may fit the bill for those looking for a relatively low-risk swing trade as well as longer-term traders or investors that might be looking for income producing ideas for some of their non-trading capital. In that December 17th fixed income overview, I covered the daily & weekly charts of NMO, a closed-end municipal fund managed by Nuveen Investments. As these previous & updated daily & weekly charts below show, NMO played out exactly as forecast with prices first bouncing off the highlighted support on the daily chart and then plummeting a whopping 20% (which is a huge drop for what is naively considered one of the “safest” investments by the general public). Most retail investors fail to fully grasp all the variables that affect fixed income investments such as changes in credit quality, real or perceived; changes in interest rates; the double-edge sword of using leverage to enhance returns (as is the case with most of these Nuveen Closed-end funds); etc…. Those chasing yield back then & not heeding the glaring warning signs on the charts, preceded to lose 20% on their principal over the next 7 months while receiving less than 3% in dividends…. not exactly the “safe” bet they thought municipal bonds were. With that being said, here are the previous & updated daily & weekly charts of NMO as well as spec sheet on the Nuveen non-state specific closed-end muni funds (which trade like ETF’s although they typically sell at a discount or premium to NAV).

The basis for adding NMO and some of these other muni closed-end funds as long trade ideas here is first & foremost the fact that the charts look bullish. These closed-end funds have fallen to key weekly support levels while extremely oversold & with positive divergences on place on the daily time frames to boot. In addition, most of these funds printed a bullish engulfing candlestick on the weekly charts last week. From a fundamental perspective these funds offer very attractive valuations. Many of these closed-end funds are selling at a discount of around 10% to their net asset value. At times these instruments sell at a premium to NAV but with the recent “rush to the exits” that I had warned about earlier this year, munis were caught up in the panic selling and even the volume patterns on these funds indicate a potential selling climax. Finally, the tax-free yields of 6.5% +, which give an even higher after-tax yield, help to “pay” for your patience in waiting, assuming that these trades aren’t stopped out or don’t pan out immediately. Again, more trade ideas in the fixed-income arena to follow soon. I also plan to add a new sub-category to the trade ideas for longer-term growth & income trade ideas, such as these muni closed-end funds.