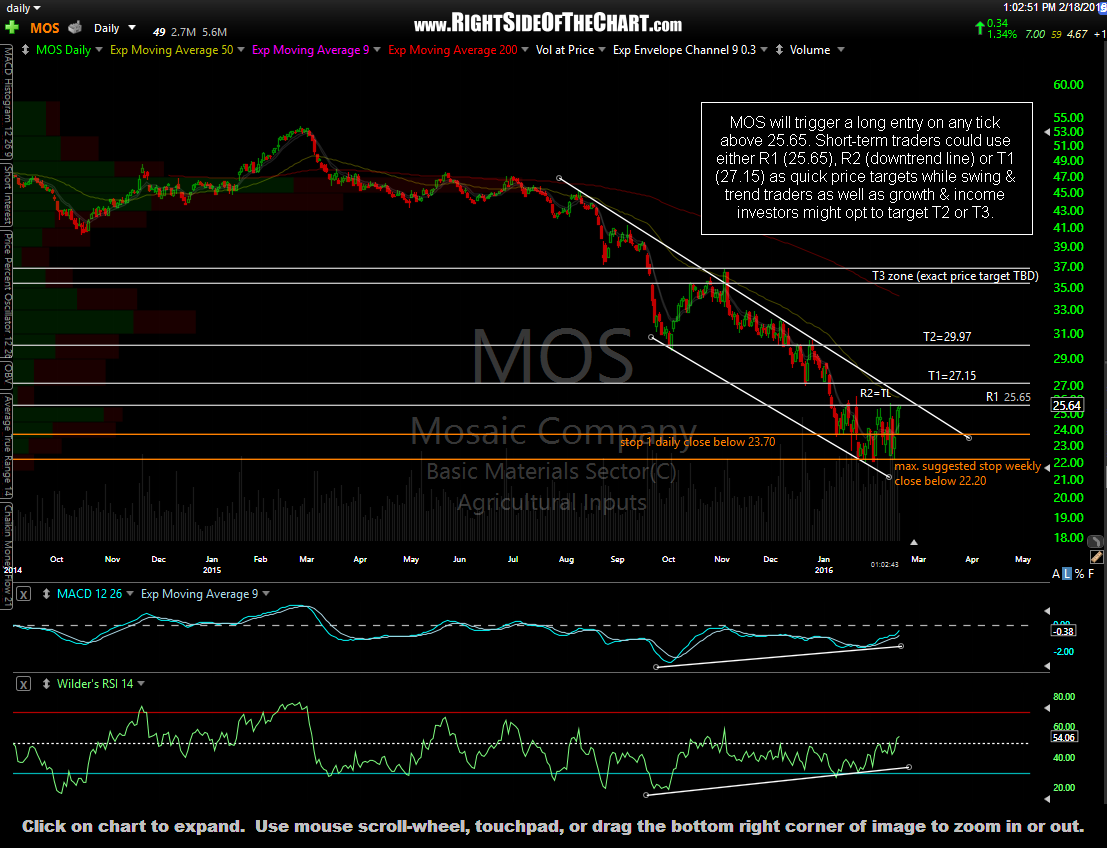

MOS will trigger a long entry on any tick above 25.65 from this point. Short-term traders could use either R1 (25.65), R2 (downtrend line) or T1 (27.15) as quick price targets while swing & trend traders as well as growth & income investors might opt to target T2 or T3. With an attractive dividend yield of about 4.3%, MOS will also be added as a Growth & Income Trade setup. The maximum suggested stop will be on a weekly close below 22.20 for those targeting T3 with an alternative, tight stop on a daily close below 23.70.

A couple of points on to mention: MOS was posted in the trading room as an unofficial trade idea in this post just over a month ago while trading at 24.14. The stock has gained nearly 7% since then. I’ve also been monitoring various companies in the agricultural input sector which MOS falls under. Both the Active POT & MBII long trades, as well as MOS are in the agricultural inputs sector & there are several more which appear to be setting up for both swing trade as well as potential long-term trading opps (on the long-side). Keep that in mind if taking any or all of the stocks in this sector as birds of a feather flock together, meaning the stocks within this sector will more or less trade in unison. As such, determine how much of your portfolio, if any, you would like exposed to this sector and then make sure to adjust your position size in each name accordingly, as to not become over-weighted in this or any one sector. Diversification in trading doesn’t only apply holding various individual stocks, over-weighting any one sector exposes your portfolio or trading account to excessive risk, should that sector move against your positions.