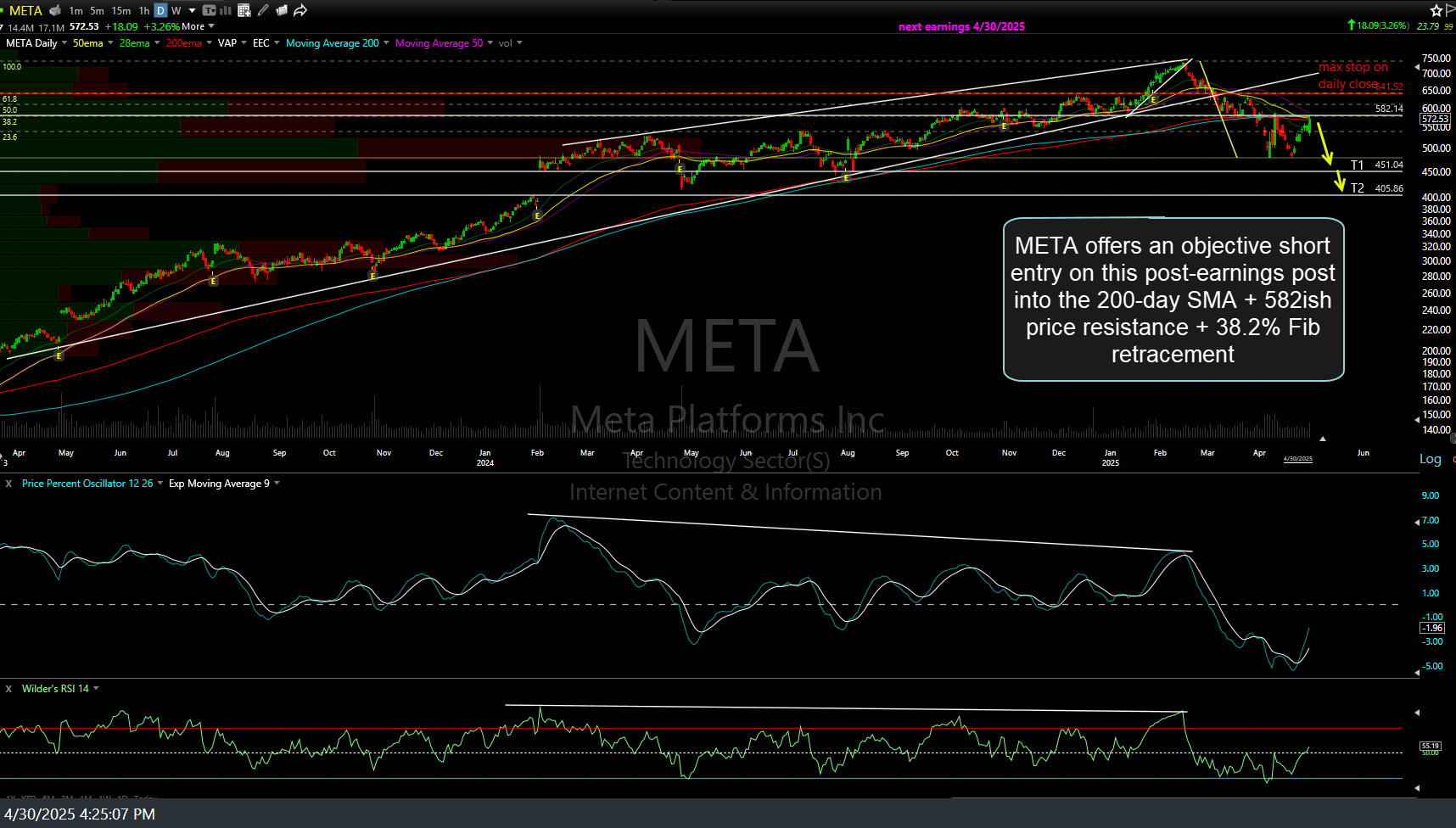

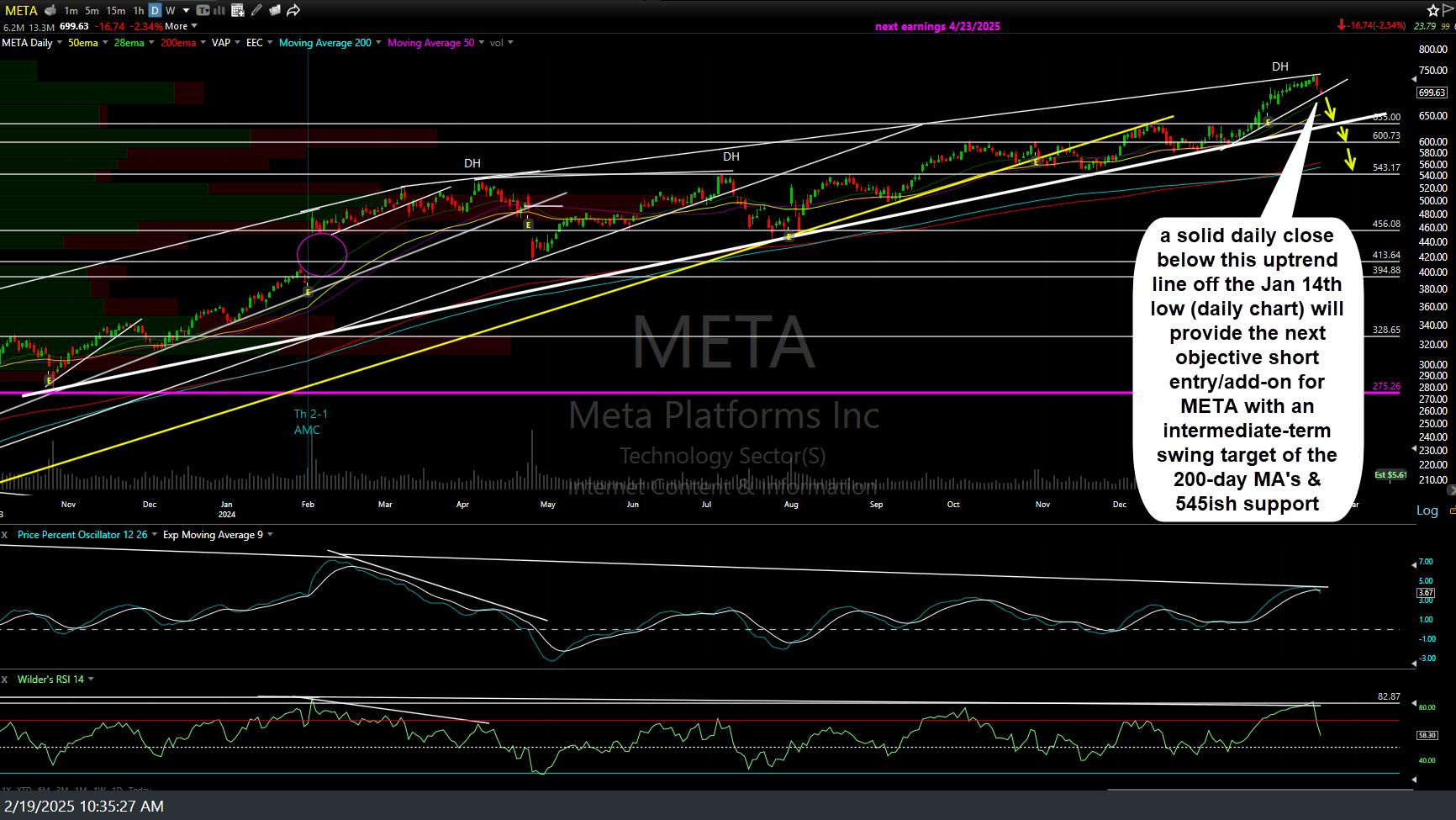

META offers an objective short entry on this post-earnings post into the triple resistance: 200-day SMA + 582ish price resistance + 38.2% Fib retracement level of the initial drop off its Feb 14, 2025 ATH down to the recent April 21st low. The maximum suggested stop (if targeting T2) is a daily close above 641.52. Daily chart below along with the last time I posted META as a short trade idea back on Feb 19th (just 2 trading sessions after that Feb 14th ATH), when few, if any, had any desire or interest to short the most bullish of the Mag 8 stocks at the time, trading around all time highs.

As per today’s video, while these rallies back to the 200-day moving averages in several of the market-leading Magnificent 7 stocks in no way guarantees they will stop & reverse here, I can guarantee these are “objective” short entries with the Nasdaq 100, the S&P 500, as well as all of the Magnificent 7 stocks currently trading below (& in a few cases, backtesting from below) their 200-day moving averages. Once again, one could also short QQQ in lieu of the MSFT, META short trades posted in the after-hours session today as well as the TSLA short trade posted on Friday.

As always, stops should be commensurate with one’s unique average entry price and preferred price target(s) using a favorable R/R of 2:1 or better.