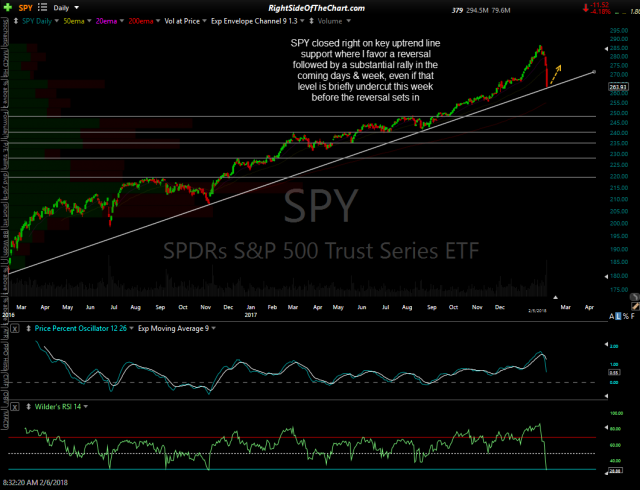

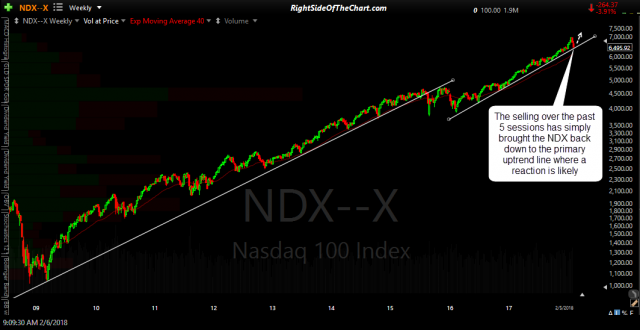

As per yesterday’s video update posted about 30 minutes before the market close, both the S&P 500 as well as the Nasdaq 100 have fallen to or very close to key uptrend line support. Although the future are currently indicating a slightly lower open as of 8:38am ET, I still highly favor a meaningful reversal & bounce off these trendlines, even if the indices undercut them on an intraday or 1-day closing basis. I will follow with bounce targets & might even add one or two of the broad market tracking ETFs as official trade ideas although I would still like to see how the market trades this week, at least in the early part of today’s regular trading session.

- SPY daily Feb 5th close

- QQQ daily Feb 5th close

Despite the sharp sell-off over the past week, which was clearly indicated in the charts well in advance with the sharp selling coming shortly after the sell signals in all of the major stock indices were confirmed here early last week, the primary trend still remains bullish. The impulsive nature of the selling over the last few sessions was simply the result of a one-side (bullish & long) trade with extreme bullish sentiment, extreme low short interest & the unwinding of an unprecedented “short volatility” trade that triggered a rush for the exits with too many market participants on one side of the trade all trying to squeeze through the same door at the same time.

- $SPX weekly Feb 5th close

- $NDX weekly Feb 5th close

As bearish as the candles look (and are) on the daily charts, they are just a blip (so far) on the monthly charts & nothing unusually so far on the weekly charts, especially considering that the current weekly candle is only 2/5ths of being finalized (i.e.- only the end of day close on Friday matters as that is when a weekly candlestick is finalized). Essentially, the selling over the last 5 trading sessions has simply brought the SPX & NDX back down for the first test of their primary uptrend lines since last September. As I often say, the initial tag of a key support level (in a while) from above is usually followed by at a reaction.

Regarding the XIV trade idea posted yesterday, as I mentioned in the comment section below that post shortly after posting the setup, due to the extreme market volatility, that trade was stopped out shortly after the post was published when XIV dropped below 95.00, providing a loss of 4.8% on the trade. XIV fell sharply after the close due to the fact that the final late day surge in the short-term VIX futures exceeded the 80% threshold that has the potential to trigger a terminal event (liquidation of the ETN). Trading is halted so far this morning & it is still yet to be know whether XIV will resuming trading and if so, at what price or whether Credit Suisse will opt to liquidate the ETN. As of now the short-term (February) VIX futures are trading down about 12%, which normally would cause a sharp rally in XIV but again, the damage may already be done to that ETN so we should know soon if & when the ETN will resume trading.