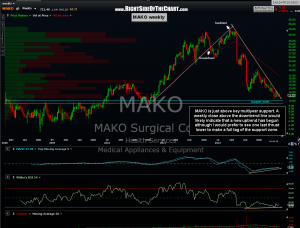

I’ve been eying MAKO for a long time, waiting for an objective re-entry on the long-side (I sold out of my long-term position early last year) and we finally seem to be getting close. As this weekly chart shows, MAKO has come a long way from it’s highs and recently fell as low as 10.35, which is only about 30 cents above the top of this multi-year support zone. That may be close enough to consider that level hit although I could easily see on last thrust lower to anywhere from the 9.50 – 10.00 area before MAKO pounds out a solid bottom.

I’ve been eying MAKO for a long time, waiting for an objective re-entry on the long-side (I sold out of my long-term position early last year) and we finally seem to be getting close. As this weekly chart shows, MAKO has come a long way from it’s highs and recently fell as low as 10.35, which is only about 30 cents above the top of this multi-year support zone. That may be close enough to consider that level hit although I could easily see on last thrust lower to anywhere from the 9.50 – 10.00 area before MAKO pounds out a solid bottom.

Since the stock has already come so close to that support zone, the downtrend could very well have ended recently. Therefore, my plan is to take a half-position on a solid break above the daily downtrend line (daily chart on right) while more conservative traders/investors might wait for an end-of-week close above the weekly downtrend line, allowing room to add a second and possibly third lot on a backtest of the daily bullish falling wedge pattern (top of the downtrend line). Depending on the volume and price action if & when a breakout occurs, I might also add to the position if the stock continues to move higher after a breakout. Initial targets are marked on the daily chart with T3 being my current preferred swing target.

Since the stock has already come so close to that support zone, the downtrend could very well have ended recently. Therefore, my plan is to take a half-position on a solid break above the daily downtrend line (daily chart on right) while more conservative traders/investors might wait for an end-of-week close above the weekly downtrend line, allowing room to add a second and possibly third lot on a backtest of the daily bullish falling wedge pattern (top of the downtrend line). Depending on the volume and price action if & when a breakout occurs, I might also add to the position if the stock continues to move higher after a breakout. Initial targets are marked on the daily chart with T3 being my current preferred swing target.