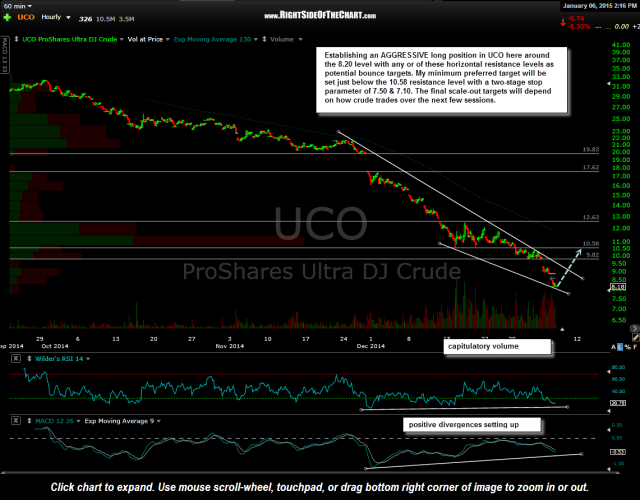

Establishing an AGGRESSIVE long position in UCO (2x Long Crude ETF) here around the 8.18 level with any or of these horizontal resistance levels as potential bounce targets. My minimum preferred target will be set just below the 10.58 resistance level with a two-stage stop parameter of 7.50 & 7.10. The final scale-out targets will depend on how crude trades over the next few sessions.

Due to the inherent price decay suffered by leveraged tracking ETFs, I typically avoid trading these vehicles for anything but very short-term trades with expected holding periods measured in hours or days, not several weeks or months.

My plan for this trade is to take an over-sized position, utilizing a scale-out approach if & when my preferred profit targets or stop levels are hit. This should be considered a very aggressive, counter-trend trade. As always, DYODD and trade according to your own risk tolerance, trading style & objectives.