In doing some clean-up on the site today the following Long Swing Trades (all associated posts) will be reassigned to the Completed Trades Archives for future reference. All of these trades were previously mentioned as having hit their max. suggested stop and/or their final price target at the time but I like to post an update with the final chart for all completed trades for the archives. This will also clear the category for some new long setups under consideration at this time.

JO (coffee ETN) hit the suggested stop of a daily close below 32.50 to close at 32.44 back on April 12th for a 6% loss. The charts of coffee along with several other ag commodities continue to set up for a potential rally although we don’t have any buy signals on coffee at this time although I will keep an eye on it as this long-term (20-year) weekly chart of coffee indicates that the potential for a high double-digit rally if we get some decent evidence of a trend reversal soon.

- JO daily May 7th

- $COFFEE 20-yr weekly May 8th

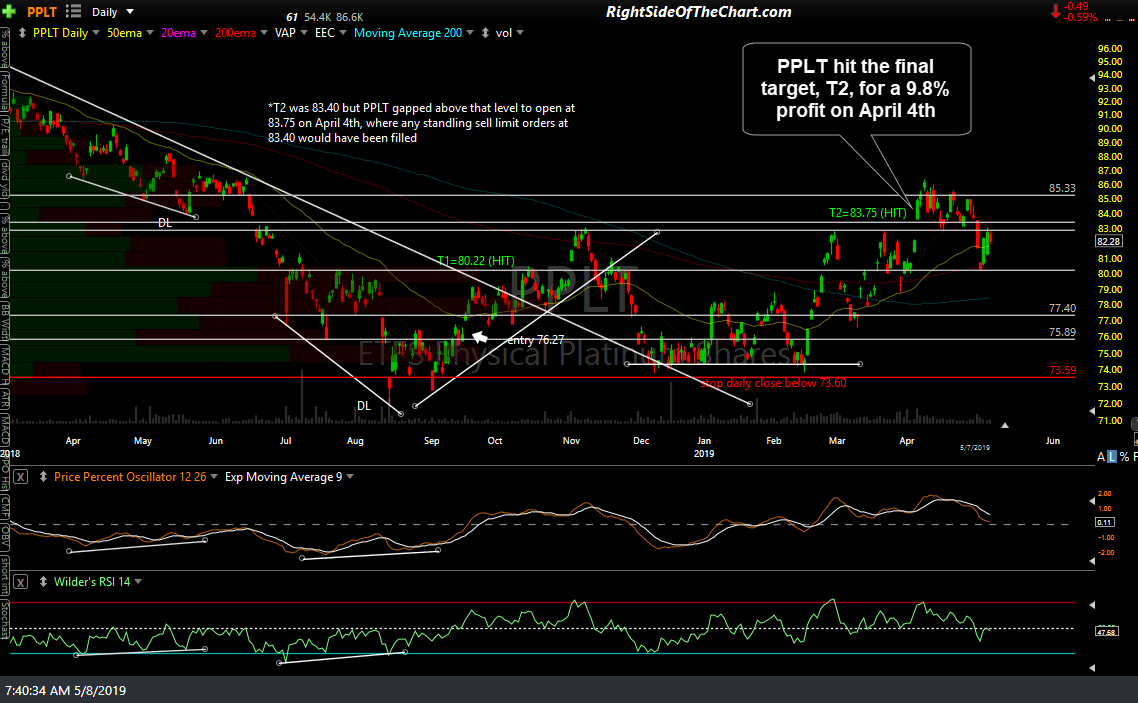

The PPLT (platinum ETF) swing trade hit the final target, T2, for a 9.8% profit on April 4th & will now be moved to the Completed Trades archives.

- PPLT daily Sept 14th

- PPLT daily Oct 15th

- PPLT daily May 8th

TVIX (2x VIX Short-term Futures ETN) hit the first price target for a 20.3% gain on March 8th at which point the stop was raised to 28.74 & then hit for a 3.4% loss for those that did not book partial or full profits at T1.

- TVIX 60-min March 1st

- TVIX 60-min March 8th

- TVIX 60-min May 7th

WEAT (Wheat ETN) hit the suggested stop of any move below 5.06 (stop triggered at 5.05) for a 5.6% loss on April 22nd. WEAT is now on watch for another potential long swing trade at this time as WEAT is setting up in a bullish falling wedge on the daily chart while wheat futures have fallen to a long-term uptrend line (support) on this 20-year weekly chart.

- WEAT 60-min May 7th

- WEAT daily May 8th

- $WHEAT weekly May 8th