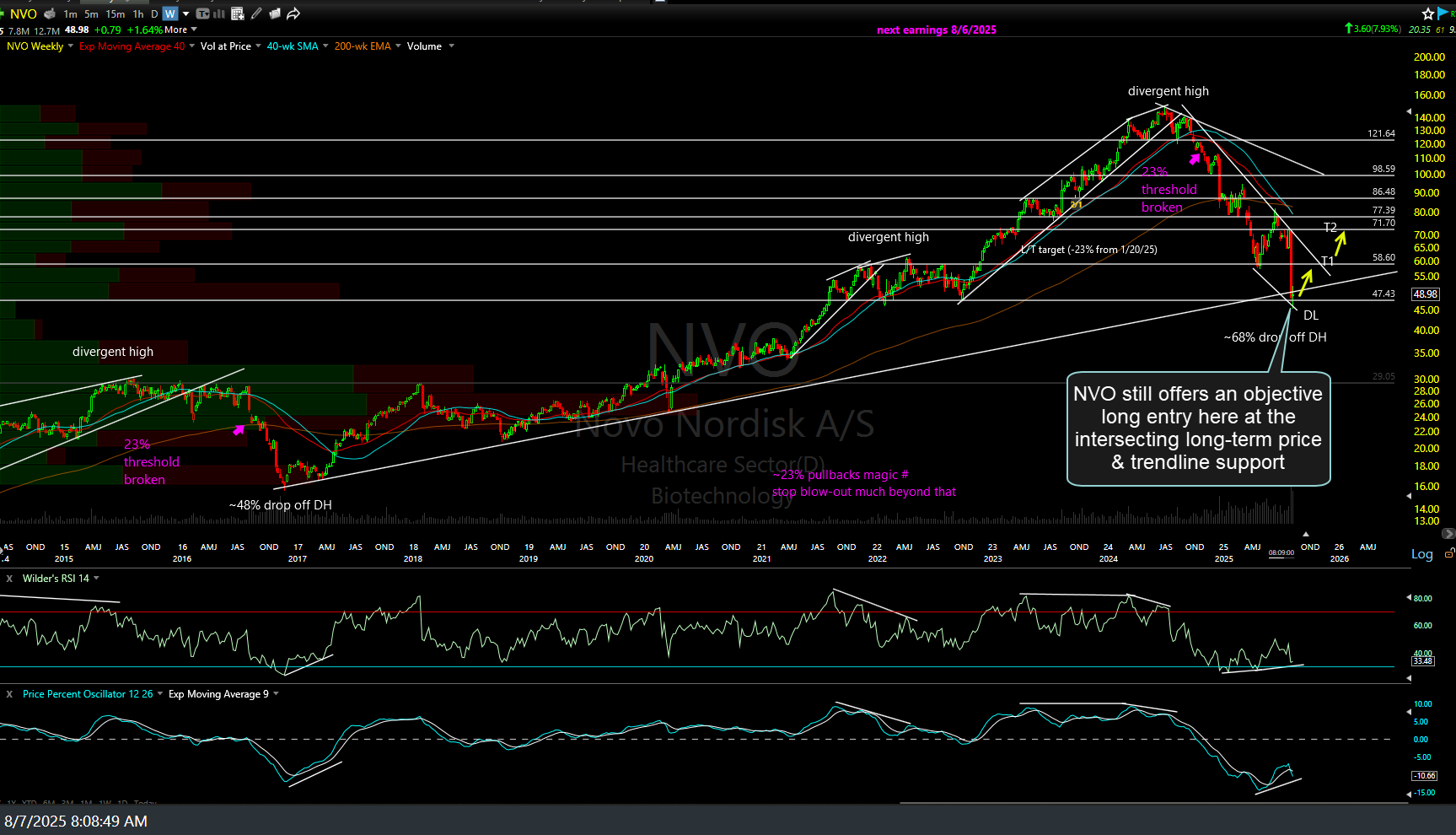

I’ve recently highlighted NVO (Novo Nordisk A/S) as an objective long entry following the 70% plunge to the dual intersecting long-term price & trendline support levels. With Novo’s biggest competitor’s (LLY- Eli Lilly & Co) earnings now out of the way, I wanted to pass along LLY as either a pure-play short trade idea or a paired trade (short LLY/long NVO) as a mean-reversion trade.

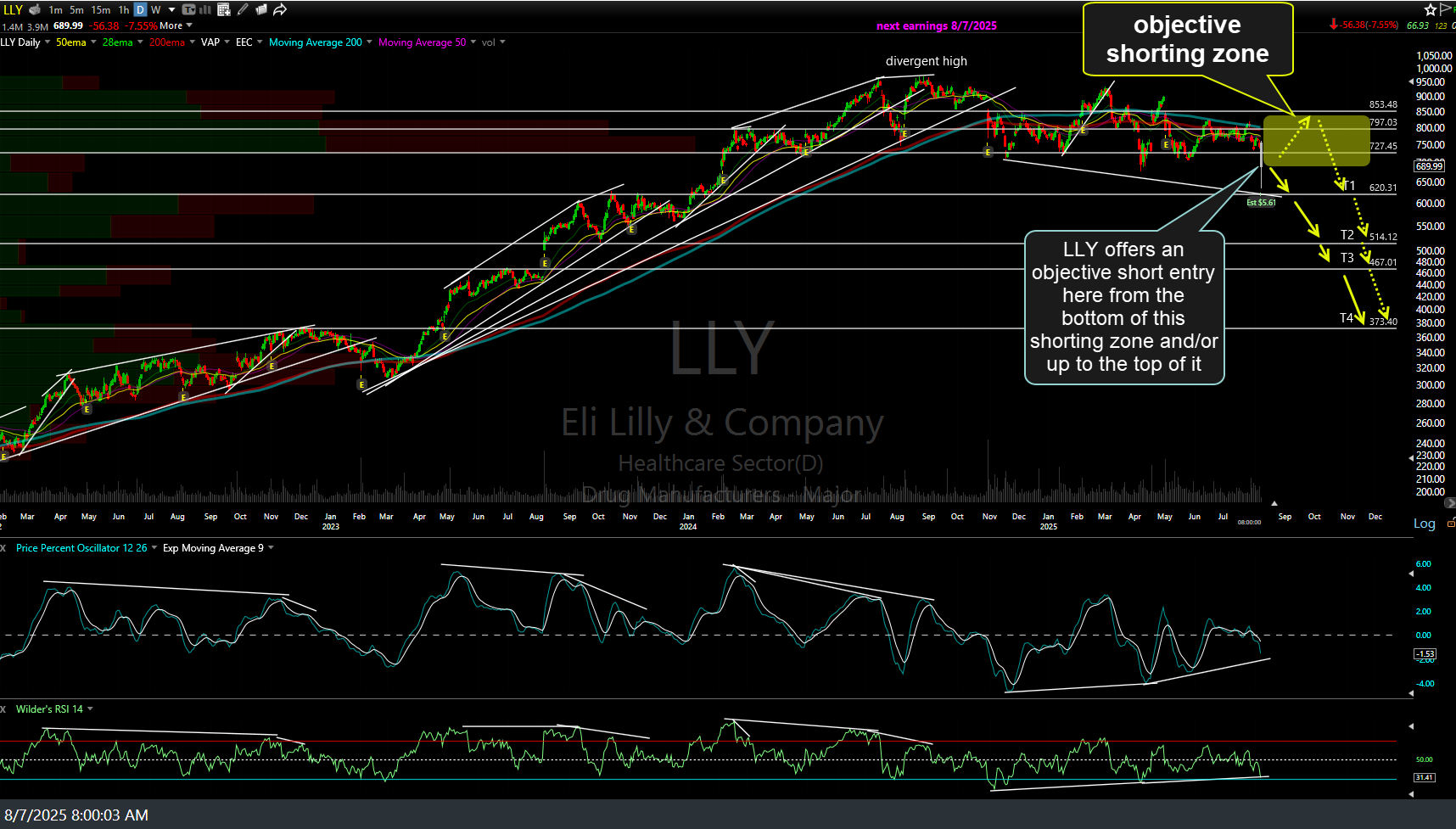

The first chart below is the LLY daily chart, reflecting this morning’s pre-market session post-earnings drop with the white candlestick. LLY offers an objective short entry anywhere from the bottom of the yellow ‘shorting zone’, where the stock is currently trading in pre-market, up to but not above, the top of it. As of now, and the day is still very young, LLY is trading down over 7%, taking the stock down below the long-term primary uptrend line on the weekly (second) chart below.

My recent analysis of NVO can be viewed by clicking on the hyperlink in the first sentence of this post or on the “NVO” ticker link below this post. Updated NVO weekly chart, reflective of this morning’s nice pre-market rally & reaction off the dual long-term support levels, below.