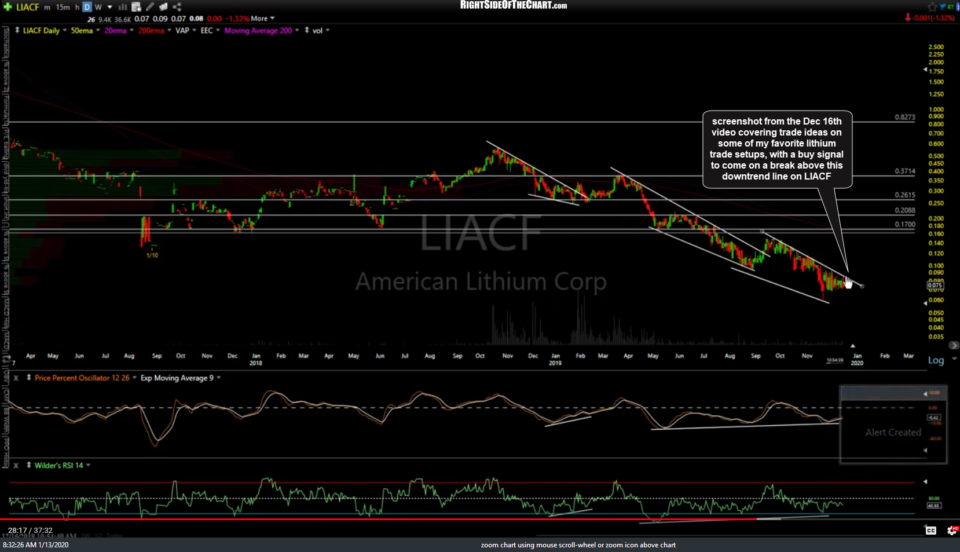

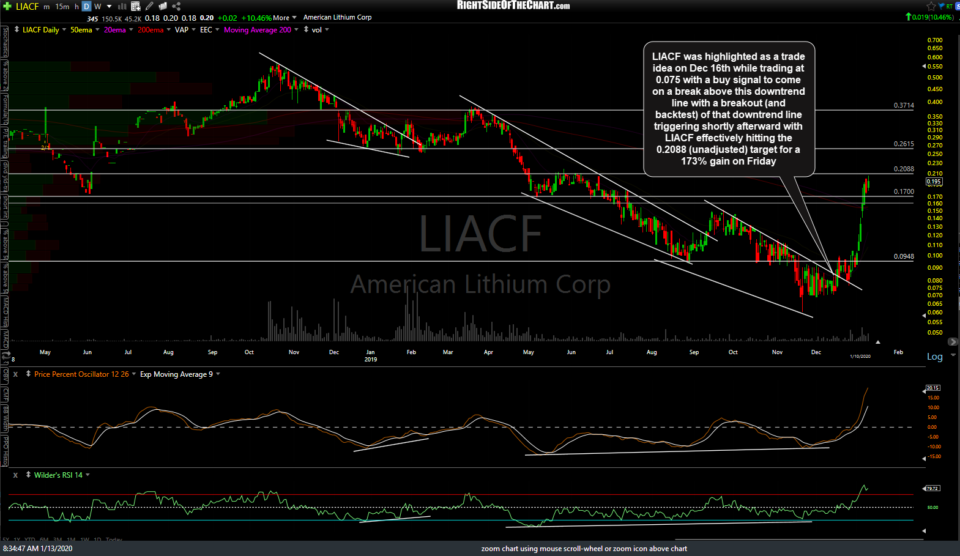

LIACF (American Lithium Corp) was one of about a dozen or so lithium stocks that were highlighted as a trade idea in the December 16th Lithium, Solar & Energy Sector Trade Ideas video. LIACF was pushing up against the downtrend at the time while trading at 0.075 with a buy signal to come on a break above the trendline. The stock went on to breakout (and backtest) that downtrend line triggering shortly afterward with LIACF effectively hitting the 0.2088 (unadjusted*) target for a 173% gain on Friday. Previous & updated (as of Friday’s close) daily charts below. *Unofficial trade ideas typically list unadjusted price targets, which are the actual support or resistance level where a reaction is likely although it is suggested to set your sell limit (closing) order on long trades slightly below the actual resistance level in case the sellers step in early).

- LIACF video screenshot Dec 16th

- LIACF daily Dec 10th

One of the reasons for this update is the fact that I’m starting to see some movement in the sector, with several other lithium stocks highlighted as trade ideas in that video also showing some bullish price action recently. In the video, I had stated that OROCF (Orocobre Limited) was one of the better-looking setups with a buy signal to come on a break above the 1.85-1.86 resistance level (which was just above the downtrend line). After a couple of intraday checks of that resistance level, the stock went on to make a very impulsive breakout & solid close above that level on January 2nd, rallying as much as 29% as of Friday while clearly the 2.27ish target/resistance level & opening the door to the 2.68-2.75 resistance/target zone. Previous & updated (Friday) daily charts below.

- OROCF screenshot Dec 16th

- OROCF daily Jan 10th

Some of the other lithium stocks covered in that video have been rallying since such as LAC +28% & NLC.V + 43%. I plan to go over the charts of the lithium stocks in my watchlist today as well as trying to dig up some additional companies with either direct (miners) or indirect exposure to the lithium sector this week & will follow up with any additional trade ideas that stand out.