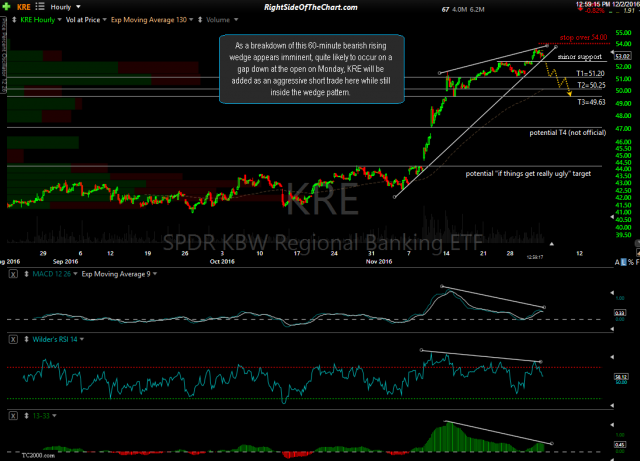

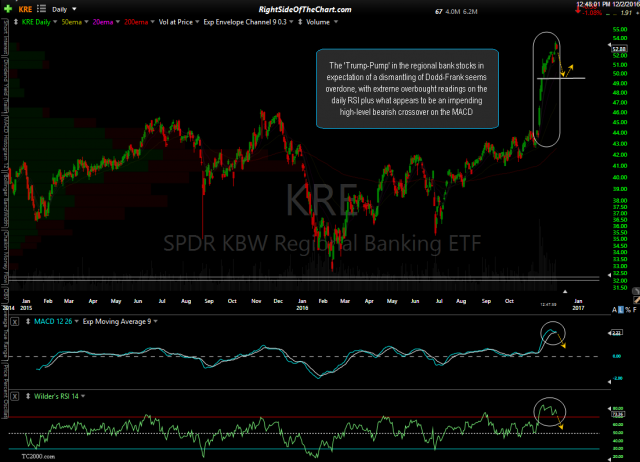

As a breakdown of this 60-minute bearish rising wedge appears imminent, quite likely to occur on a gap down at the open on Monday, KRE (Regional Banking ETF) will be added as an aggressive short trade here while still inside the wedge pattern. The ‘Trump-Pump’ in the regional bank stocks in expectation of a dismantling of Dodd-Frank seems overdone, with extreme overbought readings on the daily RSI plus what appears to be an impending high-level bearish crossover on the MACD.

- KRE 60-minute Dec 2nd

- KRE daily Dec 2nd

The current price targets are T1 at 51.20, T2 at 50.25 & T3 at 49.63 with a suggested stop on any move above 54.00. The suggested beta-adjustment for this trade is 0.80.

As this is what I refer to as an “anticipatory” trade, meaning that instead of waiting for a breakdown below support (the wedge + minor support around 52.30), as the typical rules of trading would dictate, coupled with the fact this is clearly a counter-trend trade, a short on KRE is therefore an aggressive trade, as it has yet to trigger any type of sell signal. As such, more conservative/conventional swing traders might opt to wait for a break below the aforementioned support levels.