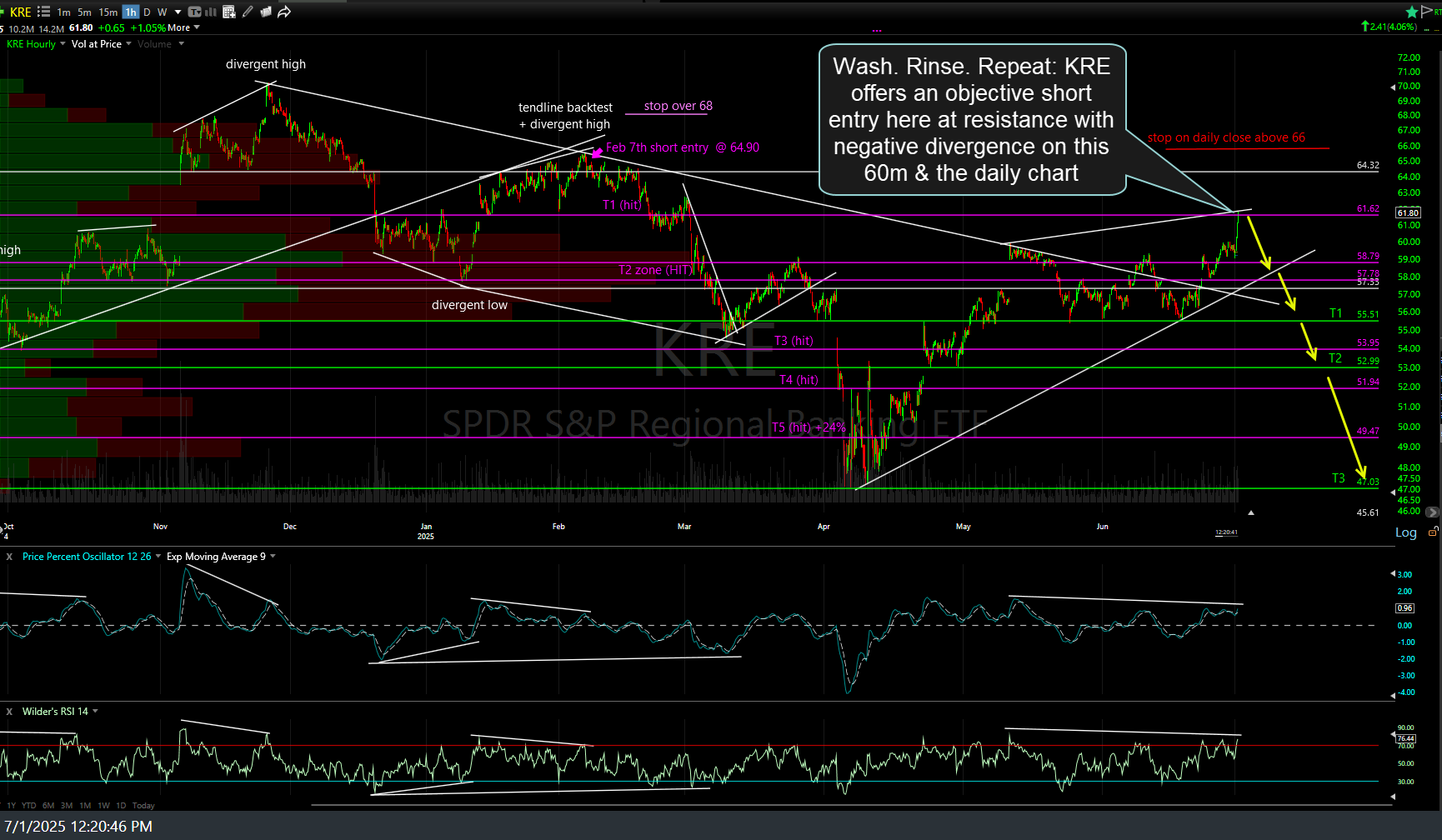

KRE (regional bank sector ETF) offers an objective short entry here at resistance with negative divergence on both this 60-minute, as well as the daily chart, with a suggested stop (if targeting the current final target, T3) of a daily close above 66.

As with the last time I posted KRE as a short trade back on February 7th, when KRE was within spitting distance of new multi-year highs, the majority of investors & traders are bullish & wanting to go long the regional banks. As with back then (previously charts below), there is no guarantee that the regionals won’t continue to rally but the charts have come full circle with the first rally into decent resistance with the first negative divergences on both the 60-minute & daily charts since that last short trade on KRE hit my final target (T5) for a 24% profit, reversing within a day or so after that & starting the rally that’s taken it back to where it is today.

As always, pass on trades that don’t mesh with your particular trading style, risk tolerance, or outlook for that particular security. The suggested stop on this trade was calculated using a favorable R/R to the current final target (T3, just above the 47ish support level) so those only targeting T1 or T2 might consider a lower stop.

Also, note that should KRE start to approach T3, the technical damage to the charts of both KRE & most likely the major indices, at that time, would most likely open the door to a much larger drop in both & therefore, I would most likely be adding additional longer-term swing/trend targets to KRE at that time.